After years of political turmoil that saw rapid turnover at the prime minister’s office, Anwar Ibrahim’s first 12 months as Malaysia’s leader might feel like a success in itself.

Except a stalled reform agenda has meant the 76-year-old has been unable to boost the nation’s revenues and pare debt, as the rising cost of living hits the pockets of ordinary Malaysians.

The lack of promised reforms — undoing hefty subsidies and broadening the government’s revenue base — is weighing on Malaysian assets, adding to the pressure from a surge in US interest rates and sputtering growth in China, the nation’s biggest trading partner.

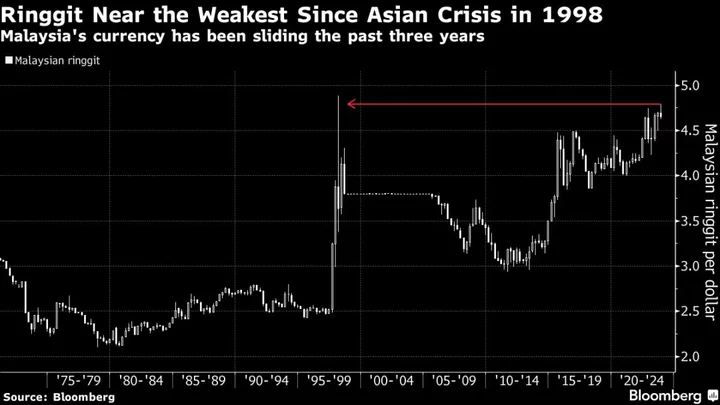

The ringgit has lost almost 6% against the dollar this year, making it the worst performer in emerging Asia. Kuala Lumpur’s benchmark stock index has been one of the biggest losers worldwide.

The political shocks that ushered in four administrations since 2018 have unnerved investors, as have the lack of of promised reforms, which have proved tricky to execute given the country’s fractious political environment.

“Headlines on the Malaysian political situation don’t boost investor sentiment,” said Jian Shi Cortesi, a Zurich-based fund manager at GAM Investment Management, whose Asia equity strategy has no exposure to the country. “Malaysia doesn’t look particularly attractive.”

Here’s how Anwar’s government has fared and the potential pitfalls it faces:

Political Stability

It’s been a striking comeback for Anwar, whose career has included a stint as deputy prime minister and two jail terms that he said were politically motivated.

His promise for reforms had fueled hopes that he would be able to repair Malaysia’s international standing, following the 1MDB investment-fund scandal that led to the jailing of former Malaysian Prime Minister Najib Razak.

Still, political stability hasn’t been a given for Anwar. A member of his ruling alliance pulled out in September to protest a decision to drop corruption charges against Deputy Prime Minister Ahmad Zahid Hamidi — Anwar’s key ally. The premier has since managed to attract four opposition lawmakers to back him, giving him the support of 151 out of 222 members of parliament.

Voters though are getting impatient with the government’s handling of the economy. The premier’s approval rating dropped to 50% from 68% in December, according to a poll by Merdeka Center for Opinion Research conducted last month.

Anwar doesn’t know how to solve the nation’s problems, including a weakening ringgit and the rising cost of living, according to Mahathir Mohammad, a two-time former prime minister.

“A popular person is not necessarily a capable person,” Anwar’s 98-year-old arch rival said. “He does not know how to handle the government.”

Economic Direction

Anwar’s administration has spent the year outlining the country’s ambitions, including plans to scale up the nation’s renewable energy mix, while looking at ways to export renewal energy. It wants to mine rare earth minerals and raise wages. Malaysia still relies heavily on revenue from fossil fuels, with national oil company Petronas paying 40 billion ringgit ($264 million) in dividends to the government this year.

“The strategy is clear,” said Munirah Khairuddin, the chief executive officer of Principal Malaysia in Kuala Lumpur. “We are waiting to see how that translates into the real economy, the stock market.”

Anwar has revealed that Malaysia’s debt and liabilities stood at 1.5 trillion ringgit, or 82% of gross domestic product. His administration has also acknowledged the need to find new sources of revenue, though it has resisted introducing a goods and services tax, opting instead to marginally increase service taxes and introduce taxes on luxury goods and capital gains.

A Hefty Subsidy Bill

A key component of Malaysia’s fiscal position is the hefty subsidy bill it foots every year. All Malaysians enjoy subsidies on petrol, diesel, cooking oil and locally produced rice. Electricity is also subsidized with lower tariffs for most domestic users. The government’s subsidy bill, which has been growing due to rising global commodity prices since last year, will exceed 81 billion ringgit this year.

“No country can survive” such a hefty subsidy bill, Anwar has said while hoping to shift to a system that targets lower-income groups. However, a clear plan on how the subsidies will be reallocated has not been presented to the public, and anticipation of possible cuts are raising inflation risks in the country.

“The challenging domestic political landscape constrains the prospects for material revenue reform, subsidy rationalization and, ultimately the reversal of the deterioration in its fiscal metrics over the past few years,” said Moody’s Investors Service Senior Vice President Christian de Guzman.

The Reformist

Anwar has spent decades as the figurehead of the reform movement in Malaysia. His government, however, is still working on several promised pieces of legislation with wide political and social implications.

A bill to introduce a two-term limit to the office of prime minister and policies to provide equal funding for opposition lawmakers — both of which his coalition advocated — have yet to materialize. Nor has a promise to separate the powers of the attorney general and chief public prosecutor.

A pledge to prohibit smoking appears to be on the back burner, while an attempt to rationalize citizenship laws, especially those concerning children born overseas, has proved to be controversial.

“Despite his clear majority in parliament, the administration does not have the political will to push for much-needed institutional and fiscal reforms,” said Asrul Hadi Abdullah Sani, a former deputy managing director for Bower Group Asia, who is now an independent analyst.

The Outlook

Anwar’s ability to execute his economic and fiscal plans within the next two years will key. A series of state elections starting in 2025 will heighten political considerations before federal polls in 2027.

If Anwar manages the short-term pain of reforming the local economy, Malaysia is poised to benefit from supply-chain realignments and increasingly positive relations with its more developed neighbor, Singapore, said Mark Mobius, the veteran emerging-markets investor, who is considering buying Malaysian stocks.

Concerns about “what reforms are possible” are partly why Malaysia’s ringgit is one of the cheapest among developing currencies that make up MSCI Inc.’s widely followed indexes, said Charlie Robertson, the London-based head of macro strategy at FIM Partners UK Ltd.

“Anwar is a smart individual who might be taken as a positive by markets,” Robertson said. “Not a negative.”

--With assistance from Joy Lee and Kok Leong Chan.