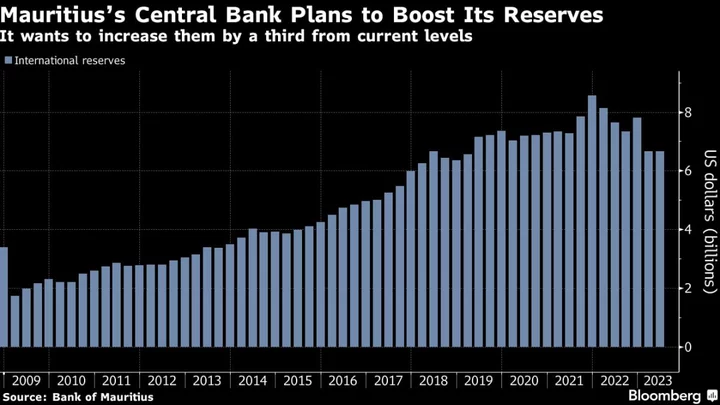

Mauritius’s central bank plans to purchase foreign currency in the domestic market to boost its reserves and provide a stronger buffer against external shocks.

The target is to reach $8 billion by June next year and then raise its holdings to $10 billion over time, Bank of Mauritius Governor Harvesh Seegolam said, provided there is no other market upheaval.

International reserves stood at $6.67 billion in June compared with a high of $8.56 billion in December 2021, data from the Port Louis-based Bank of Mauritius show.

“The objective for us is to have more months of import cover that gives the country more buffers,” Seegolam said in an interview on Wednesday. “We were able to walk through the very difficult years of Covid because of the buffers that we had. Now is the time” to rebuild them, he said.

The move signals a change in direction from the sale of foreign-currency aimed at stabilizing the domestic market because of the drop in capital inflows and tourist revenue into the Indian Ocean island nation caused by the pandemic-related slump.

Inflows picked up “significantly” in 2023, Seegolam said, boosted by income from tourism. The central bank injected only $50 million into the market in the first half of the year compared with $489 million for the same period in 2022.