It was a feast of glitz and glamor when McKinsey & Co.’s senior partners descended on Seoul last month for the blue-blood firm’s soiree.

Mayor Oh Se-hoon welcomed the attendees to the South Korean capital in a brief video. Amazon.com Inc.’s Andy Jassy beamed in and South Korean pop star Psy, famous for the viral hit Gangnam Style, performed live. Rio Tinto Group Chairman Dominic Barton, a former McKinsey global managing partner, and Hyundai Motor Co. Chief Executive Officer Jay Chang were also present.

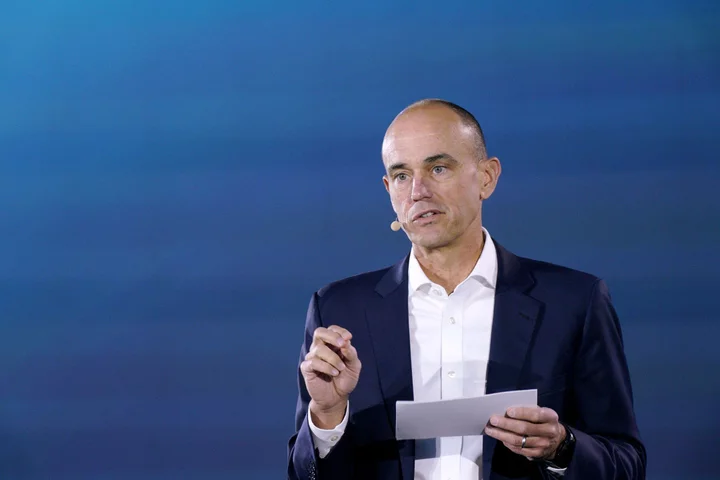

“I love that we are a CEO factory,” Global Managing Partner Bob Sternfels enthused in an address to senior partners in Seoul the same week. He then quoted JPMorgan Chase & Co. CEO Jamie Dimon: “McKinsey is the firm that solves the world’s toughest problems.”

But away from the celebrating, years of rapid expansion and a spree of costly ethics scandals have left the broader $860 billion management consulting industry slashing budgets and thousands of jobs. McKinsey hopes its cuts will protect partner pay, Bloomberg News has previously reported, and some members of the rank-and-file in firms around the world are growing discontented. The industry has paid hundreds of millions of dollars in fines and settlements, and calls for greater oversight are growing. Reputational risks and global economic uncertainty are pushing some companies and government departments to rethink their reliance on the sector.

And new blow ups keep coming. Recent revelations that the Australian arm of PricewaterhouseCoopers leaked confidential government tax plans to clients including Alphabet Inc.’s Google tap into longstanding concerns about conflicts of interest. This month, Ernst & Young said it would make changes to its US business after regulators repeatedly found flaws in its audits.

“There’s so many issues going on today,” McKinsey’s Sternfels said of the economic environment, in his comments to senior partners. His remarks, obtained by Bloomberg News, were made available to all the firm’s employees after the event.

“It means executives are questioning themselves,” Sternfels said. “And when I look around, I see the world’s best counselors.”

The firm’s closed-door event at the landmark Dongdaemun Design Plaza was shrouded in secrecy, people familiar with the matter said, declining to be identified as the details are private. The senior partners’ South Korean trip caused resentment among some staff at a time when clients of consultancies are cutting back spending, some of the people said.

“Our senior partners meet in person every 18 months to discuss the firm’s strategy,” said McKinsey spokesperson DJ Carella. “Just as we counsel our clients, we strongly believe these in-person meetings of our senior leadership are essential to defining our strategy, performance and culture.” Sternfels hopes to lead the firm for a second term when the selection process begins in early 2024, according to a person familiar with the situation, who declined to be identified discussing private matters.

The high-profile external executives who attended the firm’s event either declined to comment or didn’t respond to requests. Seoul’s city government declined to comment.

Scandals and Firings

Over the past decade, advising everyone from the US Pentagon to China’s Ping An Insurance (Group) Co. has proved to be highly profitable, lightly regulated work. Led by McKinsey, Boston Consulting Group and Bain & Co., the consulting industry has boomed: Revenue is expected to grow 8% this year to almost $94 billion in the US alone, according to research firm Source Global Research’s estimates. McKinsey’s annual revenue is set to grow in the high single-digit percent range to about $16 billion in 2023.

The Big Four accounting firms — PwC, EY, Deloitte and KPMG — have also profited from consulting work. PwC’s advisory services booked revenues of $22.6 billion in the year ended June 30, while tax and legal work brought in about half that amount. The pandemic supercharged demand, as corporations scrambled for guidance on issues like remote working and supply chain disruption. As a result, hiring exploded. McKinsey’s 45,000-strong headcount is up from 28,000 five years ago.

The dominant firms “most certainly over-recruited in 2021 and early 2022, driven by exceptionally high demand for consulting services,” said Fiona Czerniawska, CEO of Source Global Research. McKinsey — which is secretive about many aspects of its operation — has about 750 senior partners, a number that has swelled over the last few years, people familiar said. It has 3,000 partners in total.

As the Covid-driven boom has waned, layoffs across the industry have gained pace. PwC and EY are among the large firms collectively shedding thousands of staff. Even McKinsey embarked on a rare round of retrenchments early this year, with plans to cut about 1,400 roles — primarily among back- and middle-office staff.

“We continue to recruit robustly and attrition rates are near historic lows,” McKinsey’s Carella said, adding that the firm received more than a million job applications this year.

Some McKinsey employees see cuts as a way to protect compensation for the elite ranks, according to current and former staff who spoke to Bloomberg News. The firm doesn’t disclose compensation levels, but a select group of senior partners at consulting firms such as McKinsey can take home $6 million a year, some of the people estimated. At the lower end of the range, compensation is about $1 million to $1.5 million, a person with knowledge of the situation said.

Some other professional services firms will be reducing pay for members of their general partnership. In the UK, PwC’s general partners will see their compensation drop below £1 million ($1.27 million) this year following a decline in profit.

Meanwhile, EY’s broader partnership in the UK saw their share of profits drop for the first time in three years. Partners pocketed an average £761,000 last year, compared with £803,000 the year before. The firm also reduced its pay raise and bonus pool by just under a third to £155 million.

‘Wild West Mentality’

The consulting and auditing business has long had its critics: Complaints about bill padding and exorbitant rates charged for junior staff go back decades. But a succession of high-profile ethical failures have shifted the tone of the discussion. Now, campaigners are calling for more regulation and transparency, with some suggesting firms that offer audit and tax services alongside consulting should be broken up entirely.

A criminal investigation is now underway into PwC Australia’s leaking of confidential government tax plans. The accounting firm, which has pledged to bolster corporate governance and risk management, declined to be interviewed for this story and referred Bloomberg News to statements on its website.

“It’s become a test case globally,” said Allan Fels, former chair of the Australian Competition and Consumer Commission, in an interview. “There needs to be a set of disclosure requirements to resolve conflicts of interest and other ethical issues.”

Australian lawmakers have announced plans to strengthen the power of regulators, and increase fines for advisers and firms who “promote tax exploitation schemes” to more than A$780 million ($511.2 million), from A$7.8 million.

“PwC has opened the door into the big boys’ locker room,” said Australian Senator Deborah O’Neill, who played a key role in a parliamentary probe into PwC’s behavior. “What we’ve got here is a colorful reveal of a set of practices that are so egregious that they burst out of the lines of usual containment.”

Meanwhile, EY’s German business was hit with a two-year ban from accepting major new audit mandates, after failing to uncover fraud at Wirecard AG. And regulators in the US discovered flaws in almost half of the 2022 EY audits examined in a series of spot checks — a considerable deterioration from a year earlier. In an emailed statement, the firm said it takes these results seriously and is working to “drive audit quality.”

McKinsey has paid out about $640 million to resolve ongoing lawsuits over advising Purdue Pharma LP on opioid sales — work it did while simultaneously consulting for the US Food and Drug Administration — and is poised to pay $230 million more. Its South African branch has been ensnared in a government corruption scandal, and the firm faced sharp criticism for being too slow to cut ties with Russia after the invasion of Ukraine.

Some of these scandals have reignited debate over a business model that depends on partners gaining expertise from working with one client and applying those discoveries to the next. Others highlight how limited oversight is of an industry that employs 6 million people worldwide.

“For the most part, with consulting there are no certifications, no licensing — it’s kind of a Wild West mentality,” said Tom Rodenhauser, managing partner at Kennedy Research Reports, which tracks consulting firms. “The only time they get in trouble is when they get caught.”

Auditing is regulated in most major markets. In the US, the Big Four cannot provide both auditing and consulting services to the same client, and firms must meet audit standards. But most consultancies aren’t listed entities and don’t hold banking or money management licenses. Oversight of consulting is largely provided by professional standards organizations, not government agencies.

The partnership model can also make tough decisions over risky clients or imposing controls difficult to execute, current and former employees of the firms said. In April, EY was forced to scrap a proposed separation of its audit and consulting services after failing to win the approval of its more than 13,000 partners in country-by-country votes.

Real-World Consequences

In the month McKinsey’s Seoul retreat took place, the UK’s Management Consultancies Association held its biggest ever industry awards, with categories including Best Use of Thought Leadership and Team Leader Consultant of the Year.

More than 1,100 guests in black tie gathered at JW Marriott Grosvenor House London, a historic hotel overlooking Hyde Park. The event — described by its presenter as the Olympic Games of consulting — was an upgrade from the previous ceremony, according to one of the attendees.

“There is sometimes a little bit of mystery around what is management consultancy, what does it deliver,” said Tamzen Isacsson, CEO of the MCA, in an interview. The awards are a “magnificent, transparent platform” to showcase the sector’s work, she added.

Even in the face of stiff political and economic headwinds, consulting services remain popular with institutions looking to cut costs and overhaul their operations.

“Clients put a lot of trust in firms to do the right thing,” said Kennedy Research’s Rodenhauser. “Most times, it works.”

And there are still some bright spots for the industry, such as Saudi Arabia’s $500 billion Neom city project. But China — a key market earmarked for industry growth — has disappointed, due to a targeted clampdown combined with the country’s broader economic woes.

The rise of artificial intelligence is also diverting some budgets towards specialist consultancies, although AI-focused units like McKinsey’s QuantumBlack are growing rapidly too. There’s also concern that AI will soon be able to do “what legions of junior consultants have previously done,” said Nick Lovegrove, a professor at Georgetown University’s McDonough School of Business and an ex-McKinsey senior partner. PwC is already implementing an OpenAI-powered system that aims to offer AI-generated advice.

On top of all this, ethical violations can have real-world consequences.

PwC’s Australian government consulting arm — part of a local business generating revenue of A$3 billion a year — was sold off in July for just A$1. The Australian government has also slashed its spending on consultants.

Some of the professional services firms are attempting to boost their image. In an open letter in September, PwC Australia CEO Kevin Burrowes said he was “deeply sorry” for behavior that went unchecked for “many years.” EY’s UK Chair Hywel Ball suggested in October that government legislation would help overhaul the audit industry. And McKinsey has spent nearly $700 million on strengthening its risk, legal and compliance functions over the past five years. It’s also beefing up its ethics department.

How deep the soul searching goes is an open question. Regardless, an industry designed to help institutions roll with the punches has arguably never had more changes to adapt to.

“I can honestly say, I have not had a single boring day at work,” McKinsey’s Sternfels told his colleagues in Seoul. “There have been long days and difficult days, but no boring days.”

--With assistance from Matt Day, Sohee Kim, Heejin Kim and Matthew Boyle.

Author: Ambereen Choudhury, Amy Bainbridge and Irina Anghel