UK regulators blocked Microsoft Corp.’s $69 billion purchase of Activision Blizzard Inc. over concerns it would harm competition in cloud gaming, a small but growing segment of the industry.

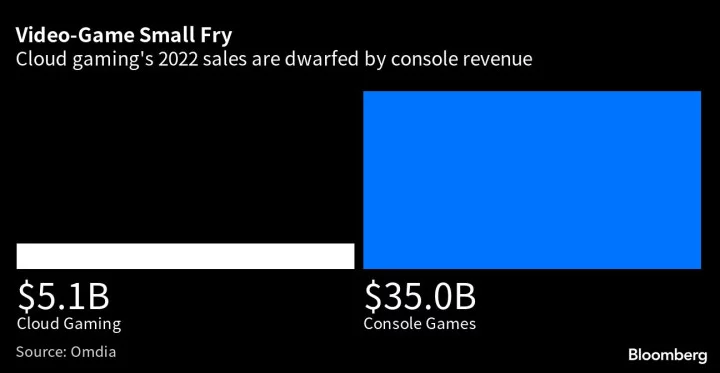

Analysts expressed surprise Wednesday that UK regulators would move to thwart a deal in a nascent field where companies are still finding their footing. Cloud gaming is dwarfed by the larger console-based business.

The UK Competition and Markets Authority ruled Wednesday that Activision titles like Call of Duty would bolster Microsoft’s edge over rivals in cloud gaming, threatening growth in the sector. The companies plan to appeal.

Titles like World of Warcraft and Overwatch “will be important for the competitive offering of cloud gaming services as the market continues to grow and develop,” the authority said in a statement. The regulator concluded that under Microsoft, Activision wouldn’t have enough incentive to seed its games across multiple services.

The UK decision could ultimately stop the deal if Microsoft is unable to win on appeal. The merger agreement expires on July 18, though it can be extended. The breakup fee is $3 billion.

Read The CMA Statement Here

Analysts were baffled that concerns over the evolution of cloud-based play could prove fatal to the biggest-ever deal in gaming. After three years, Alphabet Inc.’s Google shuttered its Stadia cloud-gaming offering in January, while Amazon.com Inc.’s Luna has seen dozens of games leave its subscription service.

Cloud-based gaming services generated just $5.1 billion in 2022 revenue, while console-game sales amounted to nearly $35 billion, according to research firm Omdia.

Read More: Microsoft’s Activision Deal Chances Evaporate After UK Blow

“It’s just not a big market,” said Michael Pachter, an analyst at Wedbush Securities, citing cloud gaming’s volatility and potential to change. “It doesn’t make sense that Microsoft would keep nascent cloud gaming services that haven’t even been imagined yet from launching by locking up content.”

He compared the agency’s reasoning to the idea that no other streaming service could compete with Netflix Inc.

Cloud gaming involves streaming from data centers to devices, including mobile phones and smart TVs. Some analysts and executives argue the market could one day eat into gaming consoles’ market share by increasing access to top-tier games on less sophisticated hardware. Success in the market depends in part on the strength of gaming services’ catalogs, the CMA said.

While standalone cloud gaming services have struggled to penetrate the mainstream gaming market, Microsoft’s Game Pass subscription service, which has a cloud gaming offering, is popular and growing.

As part of a Netflix-for-games approach, Microsoft charges 25 million-plus Game Pass subscribers $10 to $15 a month to play over 400 games across the Xbox game console, Microsoft’s Windows PC operating system, smart TVs, tablets and smartphones. The Game Pass’s highest-tier offering lets users stream games from Microsoft’s international network of data centers to their phones with Xbox’s beta Cloud Gaming service.

Microsoft currently has a 60% to 70% share of the global cloud gaming market, according to the CMA. Sony Group Corp. has a parallel offering, PlayStation Plus. Although PlayStation Plus boasts about 46 million subscribers, the service doesn’t offer splashy new releases on their day of launch. Sony also doesn’t own its own data centers.

Analysts on Wednesday questioned whether the CMA was making an apples-to-oranges comparison between the Microsoft Game Pass’s cloud offering and those of Amazon, Sony, Nvidia Corp. and others.

“I think they’re rather misinformed on what the cloud gaming market is,” said Joost Van Dreunen, who lectures at New York University’s Stern business school. “They’re conflating cloud gaming with the revenue model. Then they’re looking at it as a distinct technology and a market in another sense.”

For example, the CMA may be overstating the Game Pass’s role in Microsoft’s cloud gaming dominance when cloud gaming is just one feature of the service.

“I don’t think we can compare the way Microsoft uses cloud gaming to the way Amazon uses it for Luna,” said Joost Rietvalt, an associate professor of strategy and entrepreneurship at University College London’s School of Management. “The market share is driven by the popularity of Game Pass, not the popularity of cloud gaming within gamers.”

It’s an argument that analysts say Microsoft and Activision may invoke when they appeal. Activision on Wednesday called the CMA decision “disproportionate, irrational and inconsistent with the evidence,”

UK regulators took the view that Microsoft’s dominance in cloud gaming doesn’t just apply to Game Pass. They cited the company’s network of software, infrastructure and services — ranging from the Xbox console and dozens of game studios to the Windows PC operating system and global chain of data centers.

Although Sony leads in console sales, the CMA decided Microsoft’s ecosystem gives it early dominance in cloud gaming. And the agency concluded the company’s recent deals to work with other cloud gaming providers fall short of addressing its concerns.

Agency officials have said for at least a year that they would rather err on the side of over-enforcement, since deals are tough to unwind after the fact.

Analysts have speculated that cloud gaming could one day compete with console gaming because of the high price of both developing and purchasing gaming consoles.

“Cloud gaming remains very much a nascent market, so a decision to block is looking quite far into the future,” said Vili Lehdonvirta, a professor of economic sociology and digital social research at the University of Oxford. “Of course we have existing examples where tech giants have used their dominance in one market to capture another market that’s emerged.”

The decision means both companies will have to get more serious about planning a future without the other. Microsoft, for example, has expressed interest in launching a store for mobile games, where Activision’s King division is a big player with titles like Candy Crush.