Nationwide Building Society and Atom Bank Plc announced increases in mortgage rates on Thursday, joining a flurry of UK lenders who are raising prices in response to inflation.

Nationwide said in an email that it would raise fixed rates by as much as 0.7% on Friday, while Atom Bank announced increases from 0.25% to 0.6% on certain products due that same day. Clydesdale Bank, part of Virgin Money, said it would withdraw all new business mortgage products at 5 p.m. local time on Thursday due to high demand.

“With the continued upward trajectory of swap rates in recent times and lenders across the market increasing rates, we are having to make some increases,” a spokesperson for Nationwide said. “These changes are in line with the movement in swap rates and ensure that, as a building society, we can continue lending to all types of borrowers.”

A spokesman for Virgin Money said it had acted to protect service levels and expected to launch a new product range next week. A representative for Atom wasn’t available for comment.

Pressure is building again amid a rush by lenders to pull products as bond yields rise to levels last seen in 2008. On Monday, Banco Santander SA paused some mortgage deals for new borrowers and NatWest Group Plc increased prices, while HSBC Holdings Plc told brokers on Thursday it would raise rates for the second time this week.

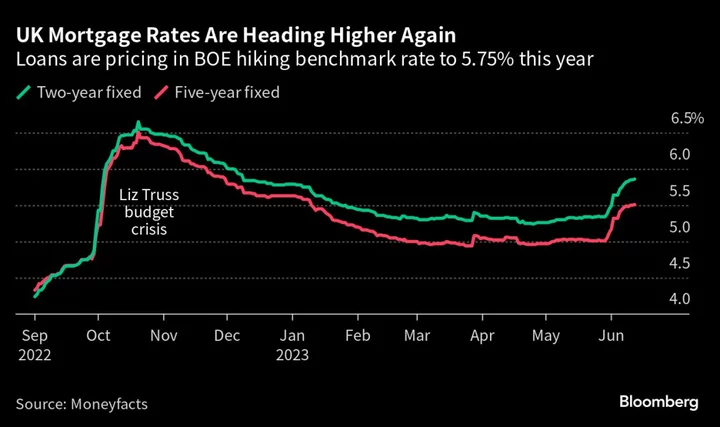

The average UK two-year fixed-rate mortgage rose to 5.92% on Thursday, according to Moneyfacts Group Plc. That’s the highest since December, when rates were easing after an ill-fated government budget plan fueled a market meltdown.

Meanwhile, the average two-year fixed-rate mortgage across the nation’s six biggest lenders — which includes HSBC, Lloyds Banking Group Plc, and Nationwide — surged 0.3 percentage points in a week to almost 5.5%, according to price comparison website Uswitch. That creates a headache for the tens of thousands of UK households on two-year fixed-rate mortgages due to expire in September.

(Updates with response from Virgin Money in fourth paragraph.)