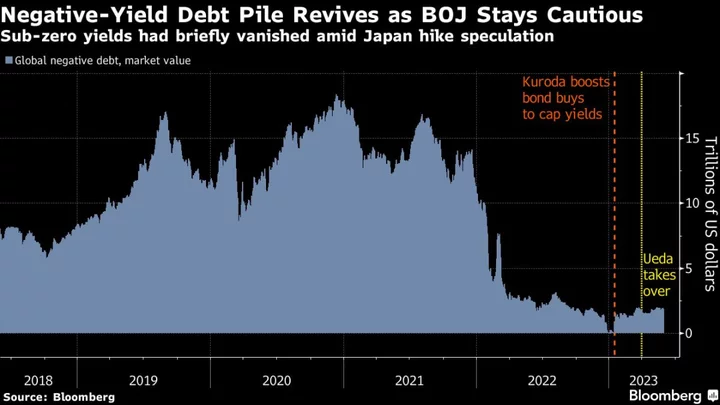

The scourge of negative-yielding debt refuses to go away for investors as the Bank of Japan’s continued reluctance to roll back quantitative easing has pushed some local yields back below zero.

For a brief moment in January, there were no bonds anywhere in the world being bought at prices that guaranteed losses over the lifetime of the debt. That came after then-BOJ Governor Haruhiko Kuroda’s shock December decision to double the benchmark yield ceiling set off a storm of speculation that policymakers would soon move to dismantle the globe’s loosest monetary settings.

Instead, Kuroda followed up with a wave of bond purchases to restrain yields, before the government tapped Kazuo Ueda to take over at the central bank in April. He immediately made it clear that any path back to normality would be a long one. On Monday, Japan’s benchmark two-year government bonds yielded -0.07%.

The banking turmoil that broke out in the US in March has also encouraged traders to bet the Federal Reserve and peers will pivot in the near future toward rate cuts.

The global stock of negative-yielding bonds rebounded to $1.93 trillion as of Friday and consists entirely of short-term Japanese debt, according to a Bloomberg gauge. That’s still a large drop from the more than $18 trillion peak reached in late 2020, when central banks worldwide were keeping rates at or below zero and buying bonds to repress yields.

“The Bank of Japan will take a long time to change its negative rate policy, while it even keeps yield-curve control, and that means negative-yielding debt will remain in the market,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. “There is no urgent need to raise interest rates from negative.”

While a closely-watched gauge of Japan’s inflation surged in April at the fastest since 1981, Ueda has indicated he sees no immediate need to join a global wave of inflation fighting, saying that the higher cost of living is still being led by cost-push factors.

Ueda Warns Against Early BOJ Policy Change Even After Price Jump

Negative-yielding debt will persist at least in the coming year as the BOJ is likely to delay a hike to short-term interest rates, said Takahiro Sekido, chief Japan strategist at MUFG Bank Ltd. in Tokyo and a former BOJ official.

“A possible removal of yield-curve control this year will cause stress in Japan’s rates market and ending the negative-rate policy at the same would cause substantial volatility,” he said. “For negative bond yields to turn positive, just bringing up the short-term rate to zero wouldn’t be enough.”

--With assistance from Masaki Kondo and Karl Lester M. Yap.

(Adds Japan’s two-year debt yield in the third paragraph.)