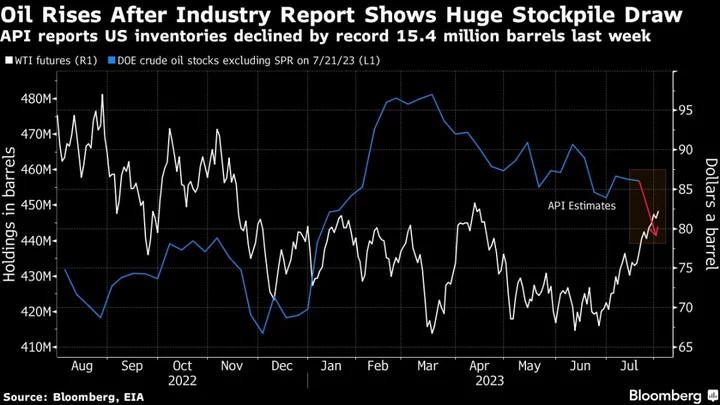

Oil resumed a rally after an industry estimate pointed to a huge drawdown in US inventories, adding to signals the market is tightening.

West Texas Intermediate climbed above $82 a barrel, overturning Tuesday’s 0.5% loss. The American Petroleum Institute reported that nationwide crude stockpiles plunged 15.4 million barrels last week, according to people familiar with the figures. If confirmed by government data later Wednesday, that would be the biggest draw in volumes terms in figures going back to 1982.

The API estimates also pointed to another drop in crude holdings at the key storage hub at Cushing, Oklahoma, as well as declines in inventories of gasoline and distillates. Separately, data from AlphaBBL also flagged a decline in oil at Cushing, the delivery point for the WTI futures contract.

Crude soared last month after the Organization of Petroleum Exporting Countries and allies including Russia cut supplies in a bid to lift prices. That’s spurred calls from banks including Goldman Sachs Group Inc. that the market will see a substantial deficit this half, with demand estimated at record levels.

“Prices are more a function of supply-side narratives,” said Priyanka Sachdeva, senior market analyst at Phillip Nova Pte. If Energy Information Administration data confirm the API figures, it “will seal the notion that there’s underlying robust consumption of fuel,” she said.

Widely-watched metrics are strengthening, with the gap between the US benchmark’s two nearest contracts at the widest backwardation since November. The spread between its two closest December contracts has moved back toward $6 a barrel in backwardation, up from about $2 five weeks ago.

Given the shift in the market, industry heavyweights including BP Plc’s chief executive officer have said they’re optimistic. Growing oil consumption and the output restrictions from OPEC+ producers were underpinning a strong outlook for prices in the coming months and years, Bernard Looney said this week.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.