Oil traders are starting to ignore the most important person in the market. It could prove a risky gambit.

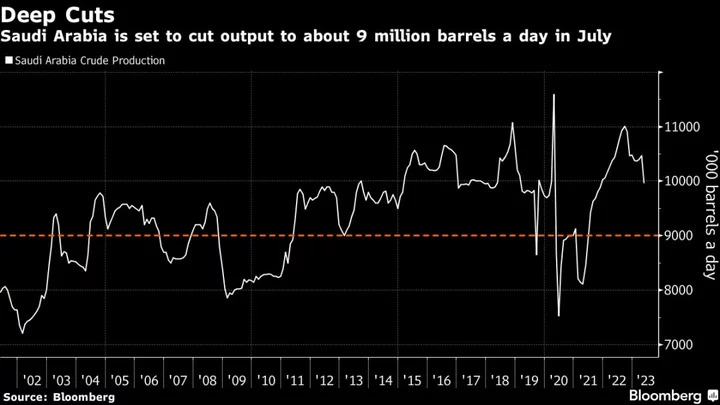

A week ago, Saudi Arabian Energy Minister Prince Abdulaziz bin Salman, pledged to unilaterally cut the country’s July oil production to the lowest in over a decade excluding Covid-19 era curtailments. He described the move as a “lollipop.”

While there have been bigger output cuts in recent months, its symbolism was important, and Prince Abdulaziz left open the possibility of extending the curb. It also came on the back of a litany of comments that suggest the prince wants to hurt those who speculate on lower prices.

And yet traders are becoming less responsive. The immediate price gain from the curbs he announced on Sunday lasted a day. By Friday at 5 p.m. in London, Brent futures were around $76 a barrel — almost exactly where they were a week earlier. A previous output cut in April took less than a month to wear off on prices.

Despite expectations that oil demand will outstrip supply in the coming months, several things are fueling the bears’ confidence. But two negatives really stand out: the first is that Russian shipments have boomed in the face of expectations that western sanctions would curtail them. The second is concern about the fate of China’s economy, for years been the bedrock of demand growth.

“There are many uncertainties, as usual, when it comes to the oil markets, and if I have to pick the most important one it’s China,” Fatih Birol, Executive Director at the International Energy Agency, said in a Bloomberg TV interview this week. “If the Chinese economy weakens, or grows much lower than many international economic institutions believe, of course this can lead to bearish sentiment.”

China’s Purchasing Manufacturing Index fell to 48.8 last month, a level that undershot expectations and was also the weakest reading since December, when the country was mired in Covid zero restrictions.

Even if its economy does accelerate anew, China will have a lot of crude to use up. The country’s stockpiles rose to a two-year high in May and several traders said they see recent Saudi oil price hikes to Asia, alongside continued OPEC+ production cuts, as part of an effort to drain that inventory.

Global Picture

That is compounding a less-rosy — but far from outright bearish — picture of global demand.

Since January, the IEA — whose supply and demand balances serve as a benchmark for the world’s oil analysts — has shaved its anticipated demand increase from second- to fourth-quarters by 900,000 barrels a day. It still still expect it to expand by a robust 1.8 million barrels a day, though some are dubious of whether it can be achieved.

Beyond China, there is a global concern about industrial production, a close proxy for diesel demand. Manufacturing has been in contraction worldwide for each of the last nine months, according to JPMorgan data, while a gauge of US trucking is at the weakest since September 2021. This week, the US cut its outlook for consumption of the road fuel.

Those dynamics are, perhaps, part of why the cuts by Saudi Arabia and its OPEC+ allies are having less of an impact.

“The producer group is in a multiple bind: demand is looking weaker and non-OPEC supply stronger by year-end than many analysts had forecast,” Citigroup analysts including Francesco Martoccia wrote. “Both OPEC and IEA forecasts have had an air of wishful thinking about accelerating demand growth.”

Sea Flows

Stubbornly high oil flows are not helping.

While they have slipped in the past few months, observed seaborne oil shipments are still up sharply compared with where they were in May 2022, a month when Chinese buying was being undermined by the country’s efforts to contain Covid.

Tracking by Bloomberg shows shipments from the bulk of the world’s exporters rtyt up 1.13 million barrels a day year on year. Russia’s cargoes, in particular, are soaring. The nation’s crude exports were within 100,000 barrels a day of a record in the four weeks to June 4, according to data compiled by Bloomberg.

That has led to a torpor in the face of supply cuts. Likewise, markets for physical barrels are — for now at least — showing little sign of major tightness, though there’s still a month before Saudi Arabia’s cut takes effect. US crude oil was this week sold in Europe at the weakest in a month. Prior cuts by some members of OPEC+ began in May.

Risky Position

Despite all that, it’s far from a risk-free bet for the bears.

With the kingdom effectively backstopping any decline in prices, some investors remain hopeful of meaningful market tightening in the second half of the year.

China’s Unipec bought oil from the US and Norway this week, a possible sign that OPEC+’s moves will boost buying of cargoes in other markets and tighten them up. Indonesia’s PT Pertamina also plowed into the market, snapping up millions of barrels of west African oil.

Booming oil refining capacity in China and the Middle East looks set to come up against a “structural dearth of crude in the coming years,” Saad Rahim, chief economist of trading giant Trafigura Group said in the company’s interim report this week.

The supply cuts by OPEC+, coupled with emerging market demand growth, should lead to “material draws in inventories later this year” he said, adding that US shale may not be able to balance the market.

But even if the market does turn, it may take time to filter through, as traders continue to wrestle with the slew up economic concerns and robust supplies that have hobbled prices for months now.

“No one wants to take risk in flat price given the macro uncertainty,” said Richard Jones, an analyst at consultant Energy Aspects. “Ultimately they are waiting to see physical markets tighten as the cuts take effect.”

--With assistance from Grant Smith.