China’s central bank is making the biggest medium-term liquidity injection since 2020, stepping up efforts to support the nation’s economic recovery and debt sales.

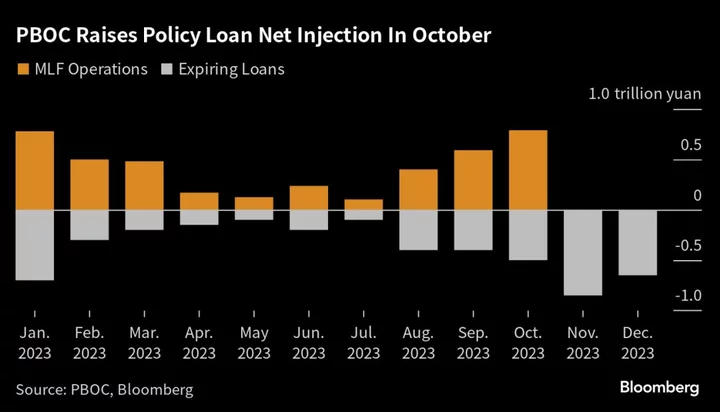

The People’s Bank of China added a net 289 billion yuan ($39.6 billion) into the financial system via a one-year policy loan on Monday, the most since Dec. 2020. It kept the interest rate unchanged at 2.5%, in line with expectations.

The nation is tussling with a stuttering economy, with consumer prices reflecting weak demand while data released last week showed the amount of loans made missed expectations. Beijing as well as local governments are ramping up debt sales to finance stimulus spending, reinforcing the need for more liquidity in the financial system.

The cash injection should “offset the demand from government bond supply this week,” said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group Ltd. “The tight liquidity may ease in the second half of October, as the authorities mandated local governments to spend all money raised by bonds before the end of October.”

The move by PBOC comes as Beijing considers a new round of stimulus to help the economy meet the official annual growth target of around 5%.

Official data on Friday showed a surprise flatlining of the consumer inflation rate last month, though other recent indicators such as exports have suggested the slowdown may be moderating. Authorities have rolled out piecemeal measures to buttress the economy but refrained from big stimulus.

China’s monetary policy will make better use of both aggregate and structural tools, central bank chief Pan Gongsheng said in a statement on Saturday, referring to broad moves that affect overall liquidity and targeted ones to aid certain industries. China will seek more sustainable growth while maintaining a “reasonable” expansion pace, he said.

Though markets are still cautious about the precarious economic recovery, financial institutions ranging from Citigroup Inc. to JPMorgan Chase & Co. have upgraded targets for China’s economic growth earlier this month after some improvement in indicators including manufacturing activity.

--With assistance from Wenjin Lv.

(Adds comment in the fourth paragraph)