Australia is bound for a recession after rapid interest-rate increases, so its sovereign bonds offer a “fantastic opportunity” with many investors underpricing that risk, according to Pacific Investment Management Co.

Pimco is buying government debt as it ramps up its stance from an underweight position, said Robert Mead, co-head of Asia-Pacific portfolio management in Sydney. High policy rates elsewhere, such as in the Eurozone, will lead to similar economic outcomes, making longer-dated bonds attractive, he said.

“We do think it’s inevitable,” Mead said of the prospects for a recession in Australia. “To the extent that the front ends of curves are now fully priced for those sorts of economic outcomes, we’re adding across the entire yield curve.”

Australia’s yield curve inverted this month for the first time since the lead-up to the global financial crisis, an indication that bond investors are bracing for a recession. The central bank is under pressure to raise rates further after the latest jobs data, after having alternated between dovish and hawkish stances this year.

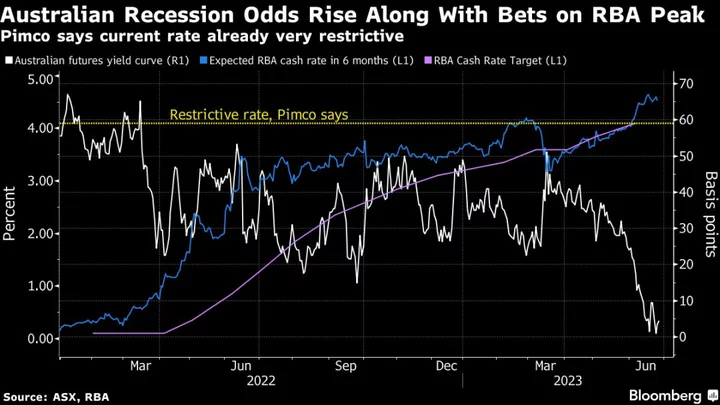

The Reserve Bank of Australia has hiked 12 times since May 2022 to take the cash rate target to 4.1%, the fastest pace in a generation. Swaps traders are pricing a 72% chance of two more increases to around 4.6% by year-end, according to data compiled by Bloomberg.

The central bank arguably needs to take borrowing costs to levels like that — well above the 2.5%-3% neutral rate — as inflation is proving sticky now that the service sector has become a key driver, Mead said. “But that will cause tremendous pain across Australian households,” he added, “We think rates at 4.1% are already very restrictive.”

Yet, investors are only gradually coming to terms with the recession prospects, such as by moving into term deposits, and should be buying sovereign bonds that will outperform in a slowdown, Mead said.

Some of Australia’s biggest pension funds have issued similar calls. AustralianSuper Pty has expanded its allocation to bonds, while the Australian Retirement Trust increased the duration of some portfolios.

To be sure, a policy-induced recession in Australia may be “relatively mild” with sectors such as tourism and education supporting the economy, Mead said. Any fillip from China will be marginal as Beijing’s policymakers are unlikely to turn to infrastructure and property stimulus — moves that would provide a boost to Australia’s commodity exports, he said.

Here are other comments from Mead:

On RBA’s policy rates

There may be some fine tuning of policy, but policy will need to remain restrictive for an extended period. We need to be realistic about what’s required to get inflation back to target and there has to be some pain. Core inflation is too high, and the very low unemployment rate is arguably continuing to add to inflationary pressures.

On quantitative tightening by the RBA:

So every month that QT doesn’t happen, there’s one month less duration in the RBA’s portfolio. It’s an active decision to do nothing because these things mature quickly, roll down yield curves quickly, and then by doing nothing the problem sort of naturally goes away. I think they’ve been quite explicit to not expect any updates until Q4.