A South Korean battery parts maker for Porsche’s Taycan sports car is targeting a 100-fold increase in revenue from silicon anodes by the end of this decade, betting automakers will keep pursuing better performance for electric vehicles.

Daejoo Electronic Materials Co. anticipates revenue from its silicon anodes used in EV batteries will rise to 3 trillion won ($2.3 billion) by 2030, up from 26.6 billion won in 2022, according to Chief Executive Officer Il-ji Lim. The company predicts the silicon components will account for at least 90% of its total revenue in the same period, up from 15% last year.

To capture the burgeoning market, Daejoo plans to boost production capacity to make enough components for about 4 million EVs annually by 2025. The Siheung-based company is building two new factories and seeking to replace materials imported from China with those from Korea to comply with US President Joe Biden’s Inflation Reduction Act that pushes automakers to reduce reliance on Chinese components.

“We are one of few first movers in the world that succeeded in the mass production for silicon anodes,” Lim said in an interview last month. “IRA is an opportunity for Korean battery makers, but they have to gradually reduce imports of raw materials from Chinese suppliers.”

Graphite anodes are still more widely used than silicon ones, with China supplying most raw materials. While silicon anodes hold more lithium ion for faster EV charging, they are also more expensive and have been known to degrade more quickly than graphite. But Daejoo says it has developed technologies that avoid the swelling and weakening of silicon anodes during charging and discharging.

Displacing Graphite

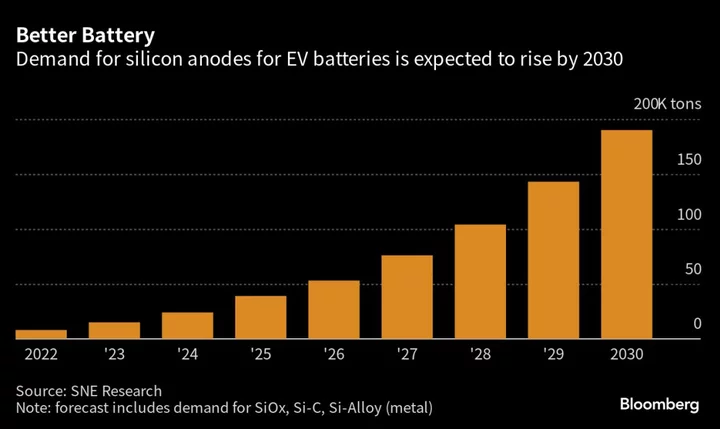

Next-generation anode technologies like silicon, lithium and hard carbon are expected to play a larger role and could displace up to two-thirds of graphite demand in 2035, according to BloombergNEF.

“The technology for cathode-active materials is reaching a limit now,” said Seung-min Oh, vice president at Daejoo. “And you can’t charge your EVs quickly by using graphite anodes only in the battery.”

Daejoo’s mass production and early entry in the market will bring costs down, according to Oh. Silicon anode, which now accounts for just 1.4% of the entire anode market, costs $60 to $80 per kilogram, compared to graphite anode’s $8 per kilogram, according to Hyunsoo Kim, an analyst at Hana Securities.

One of the new plants Daejoo is building will be located near its headquarters; another is slated for the west coast of Korea, where a cluster of battery plants from Posco, LG Chem and SK On are planned. The two Daejoo facilities will also produce battery anodes for electronic devices like smartphones, according to the company.

CEO Lim said Daejoo has been developing an anode with a tech company in North America for batteries for smartphones for almost five years, and mass production may start in 2025. She declined to mention the name of the partner.

Shares of Daejoo have risen 35% so far this year compared to a 31% gain in the Kosdaq Index.

Market Share

Automakers including Tesla Inc., Volkswagen AG and BMW AG are seeking silicon anodes for their EVs, according to a June 2 note by Kim at Hana Securities. As of 2022, Daejoo was the only company globally that produced silicon anodes for commercial purposes. However, with two Chinese rivals starting mass production this year, Daejoo is expected to fall to third in the market behind BTR New Material Group Co. and Ningbo Shanshan Co. by the end of 2023, Kim said.

Daejoo, which supplies parts to Korean battery maker LG Energy Solution, is targeting a 30% share of the silicon anode market by 2030, said Lim, who joined the company in 1993 right out of Yonsei University with a degree in biochemistry. Daejoo is also working on next-generation silicon anodes and substances to cool batteries, continuing a history of innovation, she said.

That drive for improvement is something she learned from her father, Lim Moo-hyun, who founded Daejoo in 1981 and remains a board member. The company is closely watching the growth of Chinese rivals, though CEO Lim sees Biden’s China policy hampering their global expansion.

“Most people in Korea’s battery industry forecast the Sino-US trade tensions won’t go away,” she said.