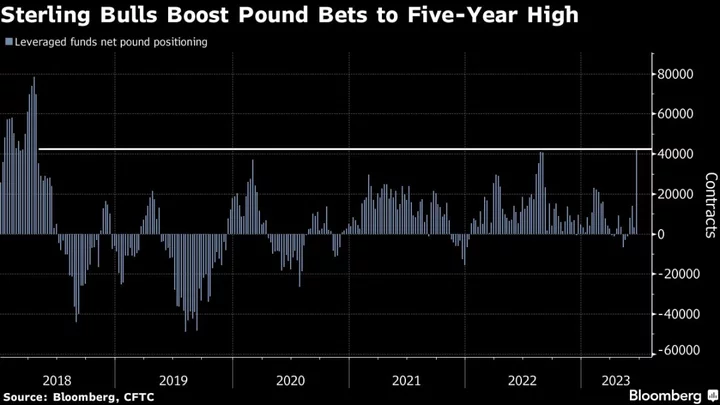

Speculative traders boosted bullish wagers on the pound to the strongest in more than five years in the run up to Thursday’s Bank of England meeting, when officials surprised markets with a hawkish half-point rate hike.

Leveraged funds raised their net long positions on sterling to 42,120 contracts for the week ended Tuesday, June 20 — the largest such amount since April 2018, according to data from the Commodity Futures Trading Commission. Nearly all of that came from a net increase of roughly 39,000 contracts during the week. The pound lost ground against the dollar last week, falling 0.7% through Friday’s close, but is still up more than 2% against the greenback in June so far.

Before the BOE meeting, markets were pricing just a 40% chance of a 50 basis point hike. After the half-point rise, traders envisage around 80% odds of another same-size move in August. From the US to Europe, Switzerland, and the UK, central banks are signaling the global fight against inflation is far from over.

That said, monetary policy could diverge in the months to come, driving currency moves in the process. Dollar headwinds will support the pound, but rates in the UK above 6% would prove a drag on sterling, according to Mark McCormick, global head of FX and EM strategy at TD Securities.

“Right now we like sterling a little higher over the months ahead, say, 1.30 is our target, largely because the disinflationary forces coming through the US are more powerful and we think the Fed’s done,” McCormick said in a Bloomberg TV interview Friday.