Bank of England Deputy Governor Dave Ramsden said he sees scope to step up the pace of shrinking the central bank’s balance sheet, accelerating its so-called quantitative tightening program.

The official also said that inflation in the UK remains “much too high” even though it tumbled more than expected in June. He declined to say how the latest released Wednesday reading may influence the Monetary Policy Committee’s next decision on interest rates in August.

“If there is evidence of more persistent pressures, then further tightening in monetary policy would be required,” Ramsden said in the text, repeating guidance the BOE has been issuing for months.

Answering questions, he said, “markets have become more sensitive” to economic data both in the UK and abroad and that indicators of persistence in prices are “above where they were” in May.

Ramsden noted that the BOE will have reduced its stock of gilts and corporate bonds by a total of £100 billion by October. However, the central bank now has almost completely run off its portfolio of corporate debt, potentially giving it space to sell more government bonds, he said.

“These factors support a carefully considered increase in the pace of reduction in the stock of gilts in the 12 months ahead,” Ramsden said in the text of a speech released by the BOE on Wednesday. “I emphasize careful — like the MPC I want QT to set a gradual and predictable pace for unwind and to let it operate in the background, after all.”

Ramsden said the MPC will announce the pace of QT in its second year at the start of October.

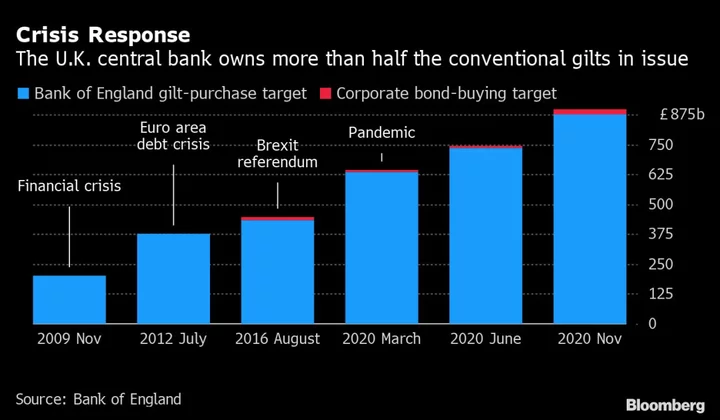

Under QE, the UK central bank bought as much as £895 billion of bonds to depress interest rates from the global financial crisis in 2009 to the end of the pandemic in 2022. The BOE says QE prevented a depression, deflation and unemployment.

The US Federal Reserve, European Central Bank and Bank of Japan all had similar programs in place since the financial crisis.

Responding to questions after the speech, Ramsden said scaling back the portfolio gives the BOE “headroom” to act again in a crisis and said he’d never rule out restarting QE or measures like in to preserve stability in financial markets.

He said officials are “quite keen to create headroom where I can, so that you don’t just get this kind of ratcheting up of the bank’s balance sheet.” He’s also wary of the BOE’s purchases “creating distortions in that market.”

Asset sales so far are having a very small impact on the economy, he said, noting that the main tool of monetary policy at the BOE remains interest rates.

“We think QT is having a very slight impact on the economy,” he said. “Probably £80 billion” of sales this year “translates into 10 basis points on yields — with really quite a small impact on inflation and GDP.”

Some economists blame the measures for widening wealth inequalities and harming productivity by tyeing up capital in unproductive businesses that would have gone under if interest rates were higher. The BOE is now winding down the assets it bought in QE in a program known as quantitative tightening, or QT, where it sells bonds or allows them to roll off the balance sheet when they mature.

Under QT, the BOE is unwinding the vast bond purchases it made to boost the economy and lower interest rates after the financial crisis and during the pandemic.

“The empirical evidence we have so far supports the theory: the overall impact of QT on gilt yields appears to have been small,” Ramsden said in the text of the speech.

QE generated gains for the Treasury for several years, but the rise in interest rates means the bond portfolio is now costing the taxpayer money as the Treasury is forced to stump up for losses that crystallize as the BOE sheds its bonds. Those costs may top £100 billion.

The BOE is currently reducing the portfolio of gilts at a pace of around £80 billion a year as assets mature and it actively sells the debt. Some £802 billion of gilts remain and the BOE has run off almost all of the corporate debt it held.

(Updates with quotes from the third paragraph.)