Australia’s inflation rate is “still too high” and the next stage in bringing it back down to target is likely to be more drawn out than the first phase, a senior Reserve Bank official said on Monday.

“This has been the experience of some other advanced economies that have been a little ahead of Australia in this inflation cycle,” Marion Kohler, acting assistant governor for economics, said in a speech. “The recent increase in fuel prices is also a timely reminder that upside surprises from supply shocks could affect headline inflation. All to say, the road ahead could be bumpy.”

The comments come about a week after the RBA raised its cash rate to a 12-year high of 4.35%, while signaling further policy tightening may still be needed with inflation expected to hit the top of its 2-3% target only by end-2025.

Financial markets see a 76% chance of another RBA hike to 4.6% by May next year. By contrast, the Federal Reserve is seen cutting rates by mid-2024.

“The big policy question that we and other central banks are having is if rates are restrictive enough to bring inflation down over a reasonable timeframe such that inflation expectations remain anchored,” Kohler said in response to a question after her speech.

“And that’s really where some of the judgment and the debate is around. There’s no question that it’s restrictive. There’s no question that the economy is growing below trend.”

Australian inflation hit a peak of 7.8% last December and has since cooled to 5.4%, suggesting the RBA’s hikes are working as intended. However, services prices remains sticky amid a still-tight labor market and surging population growth, forcing the RBA to to raise its inflation forecasts last week.

It now expects headline CPI to hit the top of its target band only by end-2025, higher than the previous estimate of 2.75%.

“If high inflation did become entrenched in people’s expectations, it would be very costly to unwind, involving even higher interest rates and a larger rise in unemployment,” Kohler said.

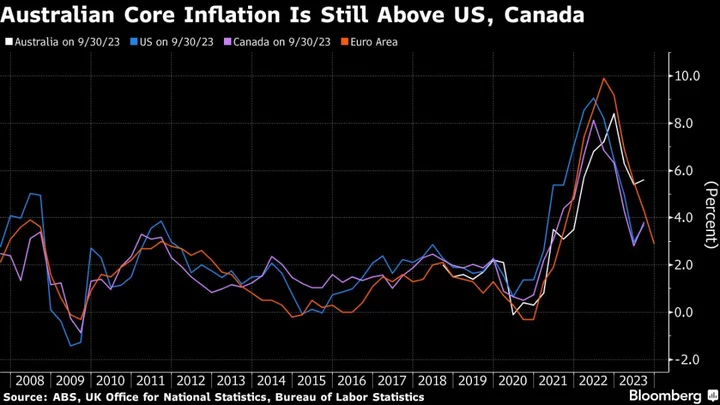

Australia has tightened at a slower pace than global counterparts, having raised rates by 4.25 percentage points compared with 5.25 points in New Zealand and the US.

The RBA’s cautious approach reflects its desire to bring the economy in for a soft landing. Policymakers are also mindful of the impact of tightening on Australia’s highly geared borrowers who are overwhelmingly on variable rates, unlike the US where most mortgages are fixed for 30 years.

Data on the economy has been mixed lately. The housing market has rebounded to near record highs and business confidence is still proving resilient. Also helping the economy is surging population growth that’s boosting demand for everything from housing to transport and dining out.

On the flip side, the country’s tight labor market is beginning to show signs of loosening, with the RBA predicting the jobless rate will soon rise from the current ultra-low 3.6%.

“We currently expect a further gradual easing in the labor market resulting from a period of below-trend growth in aggregate demand,” Kohler added

(Adds response to question in fifth-sixth paragraphs.)