The Reserve Bank of India asked lenders to set aside more cash, stepping up measures to drain liquidity in the financial system. Bank stocks fell.

The central bank ordered lenders to set aside 10% of their incremental deposits garnered between May 19 and July 28, Governor Shaktikanta Das said Thursday. The move will remove a little over one trillion rupees ($12 billion) from the banking system, he said after leaving interest rates unchanged.

The harsher step to soak up cash comes as the central bank’s key tool to drain liquidity - the 14-day variable rate reverse repos - saw a “lukewarm” response, Das said. Banks have been risk averse, preferring to park money in the RBI’s overnight facility, he said.

A gauge of banking index fell as much as 0.9%, dragging down the benchmark stocks index along with it after the move. The yield on the benchmark 10-year bond was little changed at 7.17% after falling to 7.15% intraday. The rupee traded steady.

Excessive liquidity “can pose risks to price stability and also to financial stability,” Das said. “Hence, efficient liquidity management requires continuous assessment of the level of surplus liquidity.”

The incremental cash reserve ratio increase will be effective on Aug. 12 and will be reviewed on Sept. 8 or earlier. The cash reserve ratio currently stands at 4.5%.

The immediate impact of RBI absorbing liquidity will be mild hardening of money market rates, said Madhavi Arora, lead economist at Emkay Global Financial Services Ltd. Banks will see slight impact on their net interest margins of 3-4 basis points depending on the instruments where they were parking the money, she added.

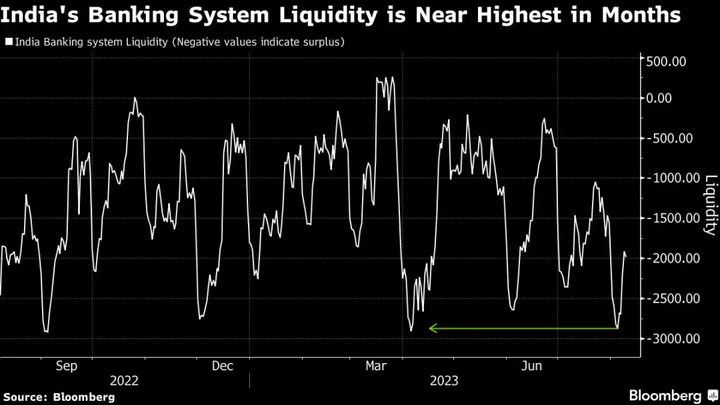

Surplus liquidity with banks has surged driven by the return of the highest denomination 2,000 rupees notes back into the banking system as well as the RBI’s forex operations.

“The key surprise for the market though was the temporary imposition of incremental CRR of 10% to absorb surplus liquidity,” said Aurodeep Nandi, India economist and vice president at Nomura Holdings Inc. Hiking the CRR would have had monetary policy connotations, so the temporary increase is aimed to be a non-disruptive way of dealing with the issue of excess liquidity, he said.

--With assistance from Ronojoy Mazumdar and Ashutosh Joshi.

(Adds Governor’s estimate of liquidity in second paragraph)