Regions Financial Corp. slumped as much as 16% after warning it expects further declines in net interest income as higher rates continue to take a toll on the bank.

The Birmingham, Alabama-based lender reported net interest income of $1.3 billion for the third quarter, slightly worse than analysts expected and a 6.5% decline compared to the second quarter. Higher deposit and funding costs contributed to the decrease, according to a statement on Friday.

The company now expects net interest income to drop 5% in the fourth quarter compared to the third quarter, according to a separate presentation. As the Federal Reserve’s moves to raise benchmark interest rates near an end, the company warned both net interest income and net interest margin will continue to decline as deposit costs normalize and interest-rate hedges kick in.

“While the industry continues to face economic and regulatory uncertainty, we are confident in our ability to adapt to the changing landscape,” Chief Executive Officer John Turner said in the statement.

Net income for the quarter climbed 15% to $465 million, or 49 cents a share. Still, that missed the 58-cent a share average of analyst estimates compiled by Bloomberg.

Check Fraud

The quarter’s results included a one-time charge of $53 million tied to check fraud. The lender had already recorded an $82 million operational loss linked to a different fraudulent check scheme last quarter.

“This game manifested itself in delayed returns, and, as a result, has had a much longer tail,” Turner said on a conference call with analysts. “After adjusting our countermeasures to identify potential fraud instances more quickly, the volume of new fraud claims has slowed. Although difficult to project, based on what we know today, we expect quarterly fraud losses to come down significantly.”

The banking industry has seen an uptick in check fraud in the aftermath of the pandemic. In February, the Financial Crimes Enforcement Network issued an alert that banks reported over 680,000 potential cases of check fraud last year, nearly double the number from 2021.

At that time, FinCEN warned that criminals were targeting U.S. Mail and United States Postal Service mail carriers and stealing personal and business checks. After the initial theft, FinCEN said these criminals would continue to exploit victims by using the personal information they got from the check to apply for credit cards or other loans.

“Fraud has increased dramatically in the industry. We seem to be the ones called out. It’s hit us very hard,” Chief Financial Officer David Turner Jr. said on the conference call. “We’re putting in new controls. We’re putting in new technology.”

Playing Catch-Up

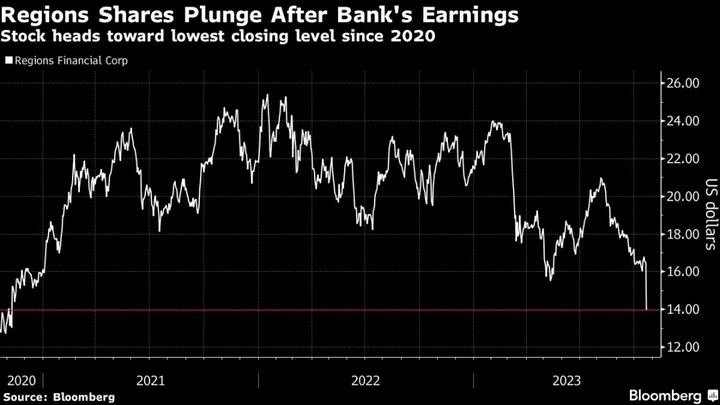

The bank’s shares plunged 11% to $14.66 at 11:39 a.m. in New York, the biggest intraday drop since March 13, the day after Signature Bank collapsed. The stock has dropped 32% so far this year, outpacing the 5.7% decline of the S&P 500 Financials Index.

Friday’s move led a selloff in bank stocks and made the lender the second-worst performer in the S&P 500. The KBW Bank Index dropped by as much as 2.7%, hitting the lowest intraday level since May.

Regions and many of its top rivals are being forced to compete harder for customers by offering higher interest rates to savers, which can erode what they earn on lending, slashing earnings. Net interest margin — a measure of how much the bank made on lending versus how much it paid out on deposits — slipped from the prior period and was also less than analysts anticipated.

Regions “has outperformed all large banks on its deposit pricing cycle-to-date, but higher for longer rates implies more of a catch-up for its low deposit pricing,” Wells Fargo & Co. analysts led by Mike Mayo wrote in a note.

--With assistance from Bre Bradham.

(Updates with details on fraud costs starting in the sixth paragraph.)