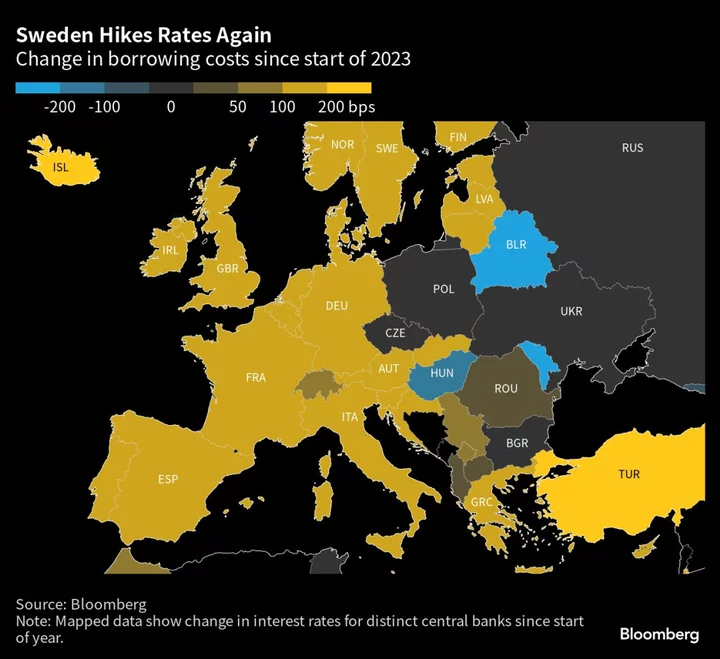

Sweden’s Riksbank raised borrowing costs and pledged accelerated bond sales, a response to stubborn inflation and a weak currency while seeking to limit fallout on a vulnerable real estate sector.

The executive board led by Governor Erik Thedeen lifted its policy rate by a quarter point to 3.75%, and said it expects to increase the rate “at least one more time” this year.

The Swedish krona hit a new record low versus the euro after the announcement, which matched most economists’ expectations, while defying some market speculation that the Riksbank could make a bigger move following half-point increases last week by Norges Bank and the Bank of England.

The central bank will also unwind asset holdings faster than previously planned by expanding monthly government bond sales to 5 billion kronor ($462 million) from 3.5 billion.

“This may contribute to a stronger krona and improve the Riksbank’s capacity to reduce inflation,” officials said in a statement. “It is still uncertain how much monetary policy tightening will be required for inflation to fall back and stabilize close to the target of 2 per cent. But the Riksbank will do what is needed.”

The currency still weakened as an immediate reaction to the decision, with the cost of a euro rising above 11.8 kronor, following a long period of decline that is making it harder to fight inflation as the cost of imported goods rises.

While inflation in Sweden has decelerated in recent months as producers’ cost burdens eased, price increases on important goods and services continue to be far higher than officials are comfortable with, as they aims to bring the CPIF inflation rate back to 2%.

In May, that measure, which strips out the impact of interest rate changes, stood at 6.7%, as prices on services rose at a rapid clip and restaurant meals and hotel stays became almost 10% more expensive.

“The Riksbank’s policy is not yet restrictive enough to control inflation,” Handelsbanken senior economist Johan Lof said in a note to clients after the announcement. “The economy remains inflationary with still high profits, rising household incomes via higher employment and accelerating wages — fueling a rising nominal spending trend, and making further price rises possible.”

While a bigger rate hike could potentially have provided support to the currency, the Riksbank must also weigh concern about how higher borrowing costs impact the country’s troubled commercial real estate sector. Samhallsbyggnadsbolaget i Norden AB, commonly known as SBB, has become emblematic of the industry’s woes as a legal battle over whether it breached its bond terms is brewing, following a downgrade to junk by S&P Global Ratings.

Other sectors of the Swedish economy have withstood the onslaught of rising borrowing costs better than expected, with exports buoying growth, and employment levels continuing to rise.

The Riksbank now projects economic output to contract by 0.5% this year, which is an upward revision from its previous forecast for a 0.7% drop in gross domestic product.

“New information, and how it is expected to affect the economic outlook and inflation prospects, will be decisive in determining the design of monetary policy going forward.,” the central bank said.

--With assistance from Naomi Tajitsu, Mark Evans and Joel Rinneby.

(Adds currency market reaction, economist comment from third paragraph.)