Sri Lanka is taking an unfavorable view toward a proposal by foreign dollar bondholders for restructuring its debt, signaling possible complications in negotiations that are key for accessing further funding to support its economic recovery.

“This proposal has not received a favorable response from Sri Lanka,” the Ministry of Finance said in an official statement, referring to a suggested plan released by the bondholder group last week. The proposal included a 20% haircut and new macro-linked bonds which would adjust payout depending on macroeconomic outcomes.

“The authorities and their advisors intend to take the necessary time to consider the proposal and assess its compatibility with parameters in Sri Lanka’s IMF-supported program,” the statement said. Sri Lankan officials and creditor nations have been batting for the need for comparable and fair treatment in the debt recast process.

“The authorities have already expressed to the bondholders’ advisers their serious reservations about the construct of the macro-linked bonds proposed by the group,” the statement added. Bondholders have diverging views on growth and exchange-rate trajectories projected under the International Monetary Fund program.

Disagreement between the authorities and investors over the terms of restructuring poses a risk to further funding from the IMF, essential to keeping a recovery in the island nation’s economy on track. Junior Finance Minister Shehan Semasinghe said Wednesday that authorities are assessing debt restructuring terms from foreign holders of its dollar bonds.

After concluding domestic debt restructuring and agreeing a tentative deal with China in recent weeks, the focus for Sri Lanka is on securing agreements with dollar bondholders and other official creditors. Sri Lanka has invited bondholders to further engage with the nation’s debt advisers, while suggesting a value-recovery instrument “if structured appropriately, taking into account the position of other creditors.”

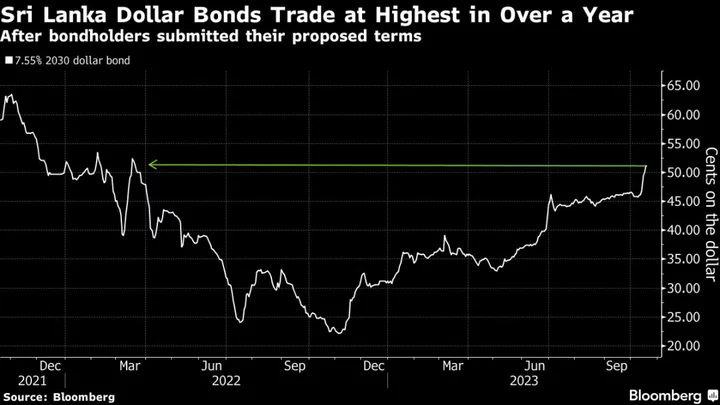

Sri Lanka’s 7.55% 2030 dollar pared early gains to trade flat at 50 cents on the dollar, while a 5.75% 2023 dollar bond edged 0.4 cents lower to 52 cents on the dollar, snapping a week of gains, according to indicative pricing compiled by Bloomberg.