Equity futures for US and Asian stock benchmarks slid while currencies held within tight ranges in a cautious start to trading Monday as the risk of a debt default in Washington cast a shadow over markets.

Movements in most Group-of-10 currencies were confined to 0.1% versus the dollar. Contracts for the S&P 500 and the Nasdaq 100 dropped about 0.3% after the gauges registered small declines Friday. Amid the global focus on the debt-ceiling negotiations and US interest rates, futures for Japanese and Australian shares fell slightly and those for Hong Kong rose marginally.

President Joe Biden and House Speaker Kevin McCarthy are scheduled to meet later Monday following a “productive” call between the pair over the weekend. Yet one Republican negotiator is insisting on a multiyear spending limit, complicating talks even as default could come as soon as June 1.

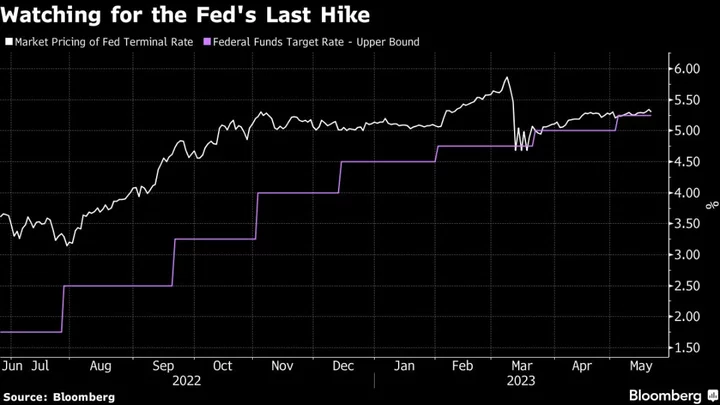

Traders also remain fixated on the path for Federal Reserve’s benchmark interest rate, with bets for a hike in June trimmed to 25% as Jerome Powell signaled a pause. Minneapolis Fed President Neel Kashkari also said he may support a pause, Dow Jones reported.

Meanwhile, markets continue to be buffeted by tension between China and the US and its allies. Beijing announced on Sunday a ban on Micron Technology Inc. as Group-of-Seven leaders meeting in Japan pushed ahead with efforts to reduce dependence on China for critical supply chains.

The S&P 500’s drop Friday halted a two-day rally as it failed to stay above the closely watched level of 4,200. The $3.2 billion SPDR S&P Regional Banking exchange-traded fund slumped almost 2% on a news report that Treasury Secretary Janet Yellen told the chiefs of large lenders that more mergers may be needed.

Stocks are primed for a precipitous drop if the US fails to raise the debt limit and delays government payments.

That’s the warning from a team of UBS strategists. Although it’s unlikely, if the US formally defaults and delays all payments beyond principal payments for a week, the S&P 500 will fall as much as 20% toward 3,400, the team led by Jonathan Pingle said.

Key events this week:

- China loan prime rates, Monday

- Eurozone consumer confidence, Monday

- Federal Reserve presidents speaking are James Bullard, Raphael Bostic and Thomas Barkin, Monday

- Eurozone S&P Global Eurozone Manufacturing & Services PMI, Tuesday

- US new home sales, Tuesday

- Dallas Fed President Lorie Logan speaks, Tuesday

- Fed issues minutes of May 2-3 policy meeting, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US initial jobless claims, GDP, Thursday

- Interest rate decisions in Turkey, South Africa, Indonesia, South Korea, Thursday

- Tokyo CPI, Friday

- US consumer income, wholesale inventories, durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.3% as of 7:13 a.m. Tokyo time. The S&P 500 fell 0.1%

- Nasdaq 100 futures fell 0.3%. The Nasdaq 100 fell 0.2%

- Nikkei 225 futures fell 0.2%

- Australia’s S&P/ASX 200 Index futures fell 0.2%

- Hang Seng Index futures rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro was little changed at $1.0814

- The Japanese yen was little changed at 137.87 per dollar

- The offshore yuan was little changed at 7.0264 per dollar

- The Australian dollar was little changed at $0.6652

Cryptocurrencies

- Bitcoin fell 0.3% to $26,776

- Ether was little changed at $1,804.69

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.67%

Commodities

- West Texas Intermediate crude rose 0.2% to $71.69 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.