TOKYO (AP) — Asian shares mostly declined in muted trading Wednesday as attention focused on prospects for improved China-U.S. relations from meetings next week on the sidelines of a Pacific Rim summit.

The Asia-Pacific Economic Cooperation forum meetings in San Francisco offer an opportunity for top leaders from the U.S. and China to mend troubled trade and political ties.

Presidents Joe Biden and Xi Jinping are due to meet then, and White House officials expect to make some modest announcements as part of the tete-a-tete, but fundamental differences in the relationship will remain unchanged.

U.S. Treasury Secretary Janet Yellen is set to meet Thursday and Friday with Chinese Vice Premier He Lifeng in San Francisco before finance ministers of the APEC member nations officially kick off the summit Saturday.

On Wednesday, Hong Kong’s Hang Seng shed 0.5% to 17,585.60, while the Shanghai Composite declined 0.2% to 3,049.92. Gloom over worse-than-expected export data offset any positive momentum from an upgrade to China's growth forecast by the International Monetary Fund. It raised its GDP growth forecast for 2023 to 5.4% from 5% but forecast that growth will slow next year.

Japan's benchmark Nikkei 225 dropped 0.3% to finish at 32,166.48. South Korea’s Kospi lost 0.9% to 2,421.62.

Australia's S&P/ASX 200 gained 0.3% to 6,995.40.

Moody’s Investors Service affirmed the Government of Japan’s A1 long-term foreign currency and local currency issuer and local currency senior unsecured ratings. The outlook was maintained at stable.

“Today’s rating action reflects Moody’s expectation that Japan’s capacity to carry its very large debt burden remains intact, underpinned by the retention of its formidable credit strengths, including robust domestic liquidity driven by the continued growth of private sector savings,” it said.

The main worries for Japan were its “structural weaknesses,” such as its aging population, according to Moody's.

Tuesday on Wall Street, the S&P 500 rose 0.3% to 4,378.38, as gains for some Big Tech stocks helped offset losses for the majority of stocks in the index.

The Dow Jones Industrial Average rose 0.2% to 34,152.60, and the Nasdaq composite gained 0.9% to 13,639.86.

TripAdvisor jumped 11% after reporting better results for the summer than analysts expected, while Emerson Electric sank 7.4% after falling short of expectations.

The majority of big companies has been topping estimates so far this earnings reporting season, but another factor has been much more influential in driving the stock market’s big swings since the summer: the bond market.

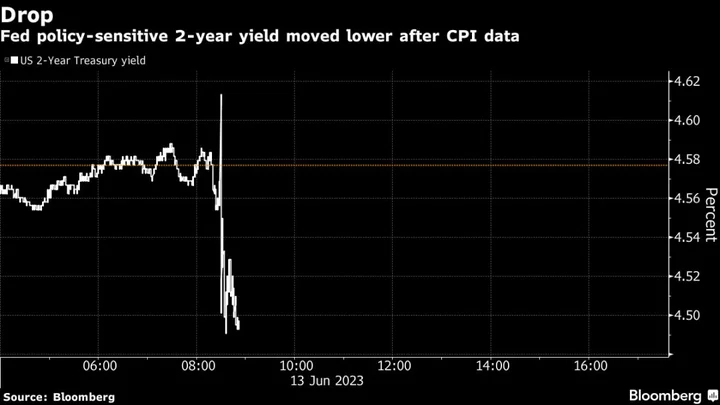

The 10-year Treasury yield was at 4.59% early Wednesday, after falling to 4.56% Tuesday from 4.66% late Monday.

Earlier in the summer, a swift rise in Treasury yields sent the stock market reeling. Yields were catching up to the Federal Reserve’s main interest rate, which is above 5.25% and at its highest level since 2001 in hopes of getting high inflation under control. High rates and yields hurt stock prices, slow the economy and raise the pressure on the entire financial system.

But yields eased sharply last week after investors took comments from the Federal Reserve to indicate it may finally be done with its hikes to interest rates. More speeches by Fed officials this week could prove to be the biggest movers of financial markets.

Shares of WeWork were not trading after the office-sharing company filed for Chapter 11 bankruptcy protection. It's a stunning fall for the company that had promised to upend the way people went to work around the world. After earlier being valued at $47 billion, its stock has plunged 98.5% this year.

In other trading, benchmark U.S. crude gave up 5 cents to $77.32 a barrel in electronic trading on the New York Mercantile Exchange. It dropped $3.45 to settle at $77.37 on Tuesday, and was back to where it was in July, before the latest Israel-Hamas war raised worries about potential disruptions to supplies.

Brent crude, the international standard, picked up 11 cents to $81.72 a barrel.

In currency trading, the U.S. dollar edged up to 150.69 Japanese yen from 150.37 yen. The euro cost $1.0689, down from $1.0702.