The jitters affecting the world’s second-biggest economy are starting to feed through into China’s gold market.

A surge in purchases by Chinese residents, driven by pent-up demand after three years of pandemic restrictions and optimism that the economy would quickly rebound, is starting to slow — yet another sign that the recovery is losing momentum.

China vies with India as the world’s biggest consumer of gold bars, coins and jewelry. Its central bank has also been a recent buyer, adding to its reserves for seven straight months after a three-year pause. Although most gold trades as a financial asset — notably as a haven for investors during risky times or as a hedge against inflation — China’s physical demand for the precious metal has helped underpin its ascent this year to over $2,000 an ounce.

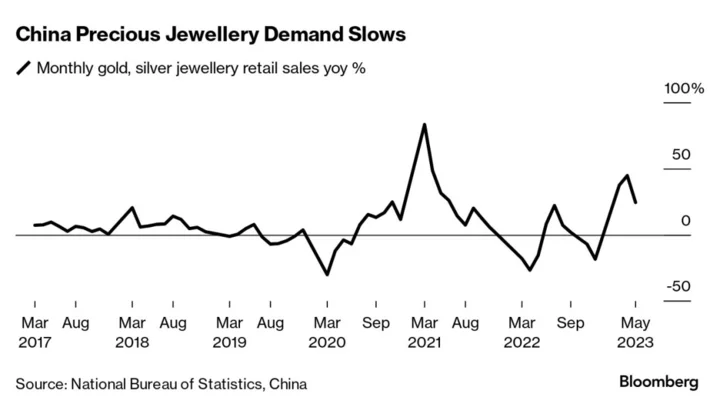

The rapid expansion in retail sales of gold and silver jewelry looks to have topped out, rising 24% year-on-year in May to 26.6 billion yuan ($3.7 billion). That’s slower than the 44% and 37% growth recorded in the previous two months. The same period last year included the extended lockdown of Shanghai, when demand for goods and services cratered across the economy.

A key demand indicator for the precious metal suggests a further weakening in June. From a premium of $44.20 an ounce in March, the Shanghai gold price is now trading at a discount to the international market, according to the World Gold Council.

“Residents are pretty cautious in spending cash right now amid various uncertainties,” said Jiang Shu, general manager of the precious metals department at Shanghai Shandong Gold Industrial Development Co. “We may not see a rapid surge in purchases again without a slump in gold prices.”

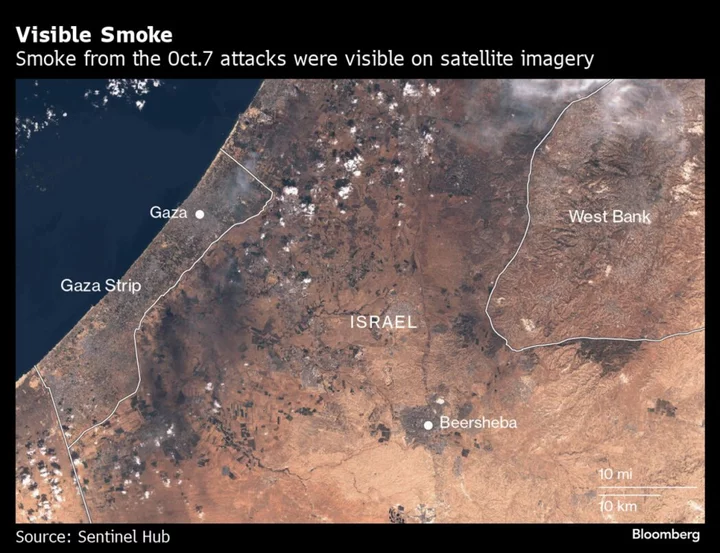

The issues that have kept international prices close to record levels are still in play: the war in Ukraine, tensions between Washington and Beijing, and inflation and recession fears across the globe. At the same time, domestic factors such as weak markets for other investments like stocks and property could help support demand.

Although China’s buying spree has slowed, retail sales should stay elevated in the near term as gold remains a sound investment while inflation concerns persist, particularly in the US, said Zhang Ting, an analyst with Sichuan Tianfu Bank Co. Further purchases from the People’s Bank of China could also offset declines in retail sales, said Shanghai Shandong’s Jiang.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Tuesday, June 20

- China sets monthly loan prime rates, 09:15

- China’s 3rd batch of May trade data, including country breakdowns for energy and commodities

Wednesday, June 21

- CCTD’s weekly online briefing on Chinese coal, 15:00

- Shanghai exchange weekly commodities inventory, ~15:30

Thursday, June 22

- Holiday in China, Hong Kong

Friday, June 23

- Holiday in China

On the Wire

Oil edged lower on concern that stimulus to revive China’s flagging economic recovery may fall short of expectations.

Chinese banks lowered their benchmark lending rates for the first time in 10 months following a reduction in policy rates by the central bank to bolster a slowing economy.

This year’s much-anticipated rebound in air travel is sputtering, with profound implications for the global oil market.

--With assistance from Sybilla Gross.