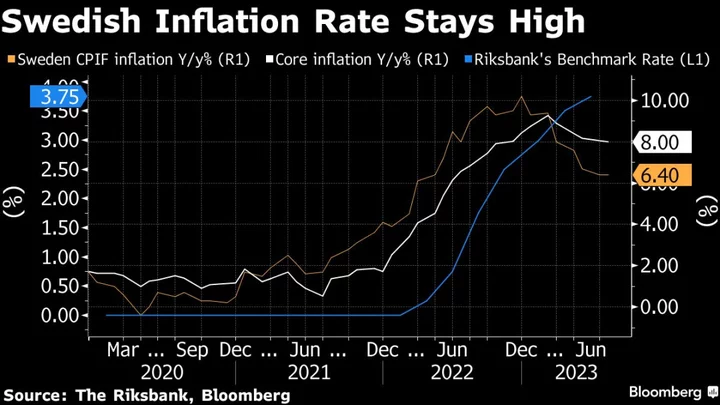

Swedish core inflation remained on an elevated level in July, keeping pressure on the Riksbank to raise interest rates further even as the economy is slowing down and cracks are widening in the country’s commercial property sector.

A price measure that strips out energy costs and the effect of interest-rate changes rose 8% from a year earlier, according to a statement published by Statistics Sweden on Tuesday. That matched the median estimate of 8% in a Bloomberg survey and was slightly higher than the 7.9% expected by the central bank.

Stubborn price increases add to the likelihood that central bank officials resolve on raising rates more than current plans indicate. Doing so would hurt landlords who are struggling to cope with heavy debt burdens, just as concern is growing that the Nordic nation’s economy is facing a hard landing after preliminary second-quarter data showed a larger than expected contraction.

Read More: Swedish Hard Landing Concerns Escalate as Economy Shrinks

The Riksbank has said it expects to increase its benchmark rate at least one more time this year, as services inflation remains high and a weak krona is making imported goods more costly.

--With assistance from Joel Rinneby and Ott Ummelas.