Switzerland’s formerly cash-obsessed citizens are falling out of love with physical money.

Some 36% of consumer transactions were settled using physical money last year, according to a Swiss National Bank survey published Thursday. That compares with 43% in 2020 — when the pandemic was raging, discouraging the use of cash — and 70% in 2017. Another 33% were settled with debit cards, 13% using credit cards and 11% via mobile payment apps.

Cash is an emotive issue in Switzerland, where every inhabitant holds the equivalent of $11,824 in bills and coins, the most in all economies where the Bank for International Settlements collates data.

On top of that, a group called the Swiss Freedom Movement recently collected more than 130,000 signatures for writing the existence of physical money into the constitution. The government decided to back the preemptive move against the spread of digital money, supporting a national vote to change the constitution in this regard.

SNB Vice President Martin Schlegel cautioned reporters not to start writing any obituaries for bills and coins.

“The decline in the use of cash has markedly slowed down,” he said Thursday in Zurich. “In more than one in three payments cash is used — that’s a strong statement that the population wants physical money.”

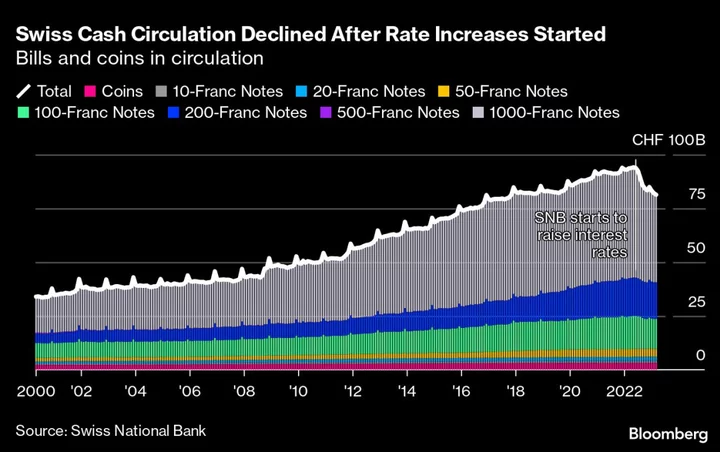

In total 81 billion francs ($89 billion) worth of bills and coins were in circulation as of March, according to SNB data. A significant part of that may be held outside the country to store value, especially since more than half of the total is in the form of 1000-franc notes, one of the highest-denomination bills of the world.

When the central bank started to raise interest rates last June, the amount of outstanding cash started to decline, but it remains well above the level it was at when borrowing costs dropped below zero.

Somewhat paradoxically, a peer-to-peer payment app called Twint also is increasingly popular in Switzerland — used by 5 million of its 8.7 million inhabitants. That contrasts with the neighboring euro area, which currently lacks a comparatively well established payment app.

Compared to 2020, the proportion of people in Switzerland who have a payment app installed on their phones surged by some 20 percentage points, according to SNB’s survey.

While the SNB remains neutral on which payment methods Swiss citizens use, Schlegel said earlier that cash use might face a “downward spiral” if more people decide to not use it any more, driving up unit costs of money logistics. “Cash is a well-functioning system, but it is not to be taken for granted,” he said.

(Updates with Schlegel from third paragraph)