Switzerland’s currency is poised to attract a fresh set of buyers as major central banks elsewhere shift their focus toward stimulating growth and away from their battles against inflation.

Traders have turned bullish on the franc in the past few weeks, something that hasn’t happened since September 2021. The shift has been fueled by an expected divergence between the Swiss National Bank, which has tightened policy, and central bankers in Europe and China, where slumping growth rates have lifted expectations for future monetary policy easing.

In the US, meanwhile, markets also expect cuts down the line even as mixed economic data provide support for potentially one more bout of tightening first by the Federal Reserve.

“We expect the CHF to appreciate in line with its multidecade trend,” said Thomas Flury, head of FX research at UBS Wealth Management in Zurich. He sees the currency strengthening in the medium to long term because of low price pressures in Switzerland and a central bank “convinced of the need to fight even these small grassroots of inflation.” Moreover, “there is also lots of room for repatriation of money that stayed outside the country during the negative interest rate period.”

The franc also remains a sanctuary for nervous investors amid geopolitical tensions, which have intensified between the US and China. The Pentagon said Saturday that a Chinese warship crossed the bow of an American warship in the Taiwan Strait, while last month a Chinese jet crossed the path of a US reconnaissance aircraft in international airspace over the South China Sea. Separately, Russia and Ukraine reported extensive fighting Monday as Ukraine’s counteroffensive looks to get underway.

Three-Month Rally

Since the end of February, the franc has strengthened 4% to about 0.9060 per dollar, the best-performing currency in the G-10 in that period.

The current Fed and European Central Bank rate-hike cycles are expected to pause later this summer with the Fed seen reducing rates at some point this year. Monetary policy in Japan and China have remained stimulative.

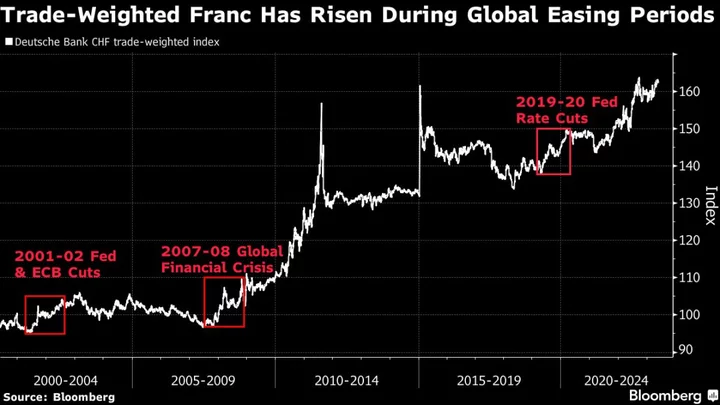

Like gold over the past two decades, the franc performs well when major central banks provide monetary stimulus. Its trade-weighted exchange rate strengthened 10% during a cycle of cuts by the Fed and ECB in 2001—2002. It rose 13% during the early part of the 2007-2008 financial crisis, adding to gains once central banks embarked on asset purchase programs. When the Fed cut rates in 2019-2020, the currency advanced about 7%.

While the trade-weighted exchange rate appears high, the franc’s long-term valuations “do not look at all stretched” after accounting for inflation differentials in other countries, according to JPMorgan Chase & Co.

The bank predicts a gradual appreciation, with the franc advancing more than 5% to 0.86 per dollar by March 2024, and by more than 4% to 0.93 per euro. With concerns about the US debt ceiling now out of the way, there is perhaps scope for about 1% to 2% weakness in the franc versus the dollar, yet “we view this as a tactical headwind rather than problematic for our more strategic bullish CHF view,” analysts led by Patrick Locke and Meera Chandan wrote on Friday.

The franc remains a good hedge against late-cycle risks and benefits from a more activist central bank as well as better yields compared with the Japanese yen, they said.

The impact of global stimulus on the franc may prove immediate as capital pipelines are unclogged and profits start flowing toward tax-advantaged destinations. Switzerland doesn’t have continuously high levels of fiscal spending and its largest public companies are less capital-intensive and not subject to the high levels of overseas competition as export powerhouses such as Japan and South Korea. This helps keep Switzerland’s trade balance in persistent surplus.

Tighter monetary policy may also bolster the currency. Chairman Thomas Jordan has said the Swiss National Bank’s policy isn’t restrictive enough and the bank is willing to use FX sales to meet its policy objective.

There are still some skeptics. Canadian Imperial Bank of Commerce in Toronto expects the franc to stay around current levels against the dollar through December 2024. It sees euro-franc climbing above parity by the end of this year, rising further above 1.05 by the end of 2024.

“The Swiss franc is a smaller currency and there are not many investable assets denominated” in it, said Bipan Rai, CIBC’s global head of FX strategy. “The ECB should have a higher terminal rate than the Swiss National Bank,” Rai said.

UBS sees the exchange rate going the other way. Last month, the bank forecast the currency will strengthen to 0.87 per dollar in September and to 0.85 in December. And it sees those gains continuing into next year, with the pair reaching 0.84 by March and 0.83 by June 2024.

“We suggest preparing for long Swiss franc positions,” and implementing them after the dollar has “clearly topped out,” Flury said, noting the current exchange rate provides an attractive entry point.