South African Finance Minister Enoch Godongwana is in a bind as he reworks the nation’s budget in the face of lower-than-expected tax revenue and pressure from the ruling party to bolster government services ahead of next year’s crunch elections.

While a commodity boom previously gave Godongwana some breathing space, recent metal price declines and rail constraints have curtailed the mining industry’s income and contribution to state coffers.

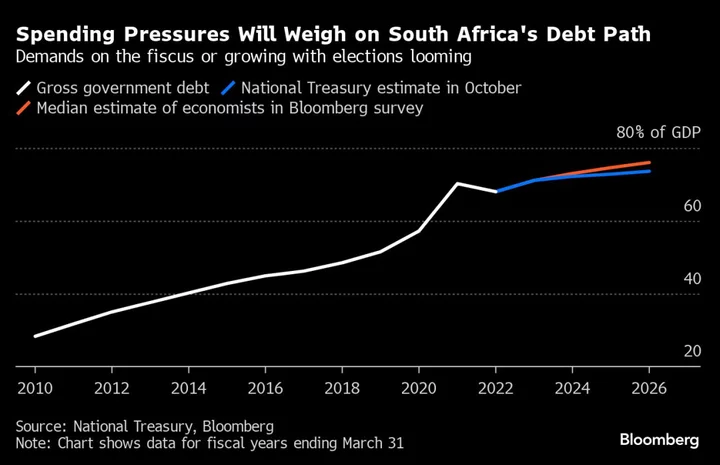

The government is likely to collect 52 billion rand ($2.8 billion) less tax than projected in February, according to the median estimate of economists surveyed by Bloomberg. They also expect the consolidated budget shortfall to be 5.3% of gross domestic product in the current fiscal year, wider than the National Treasury’s projection of 4%.

To balance the books, Godongwana has signaled that he will trim spending and raise borrowing when he delivers his medium-term budget statement in Cape Town on Nov. 1. Any plans to increase taxes will typically be announced in the main budget in February. All those options will encounter fierce opposition from different quarters.

“The first thing he must say is it’s impossible to continue borrowing money,” said Jannie Rossouw, an economics professor at the University of the Witwatersrand in Johannesburg. “Then he must give us a clear idea of where the reprioritization would come from, where will he spend more and where will he spend less.”

President Cyril Ramaphosa and the ruling African National Congress have pushed back against austerity measures, an unsurprising response given that opinion polls show the party risks losing its national majority in the upcoming vote for the first time since it took power in 1994.

“The problem with debt is the capacity of the economy to service it,” Godongwana said in a speech over the weekend, in which he revealed that the Treasury will be forced to raise additional funding to limit expenditure cuts. “In this environment, in this trajectory, our ability to service that debt is becoming constrained and therefore we have got to do something about it.”

Natig Mustafayev, emerging markets portfolio manager at Barings, considers it unlikely that there will be any good news in the budget, with the elections adding to spending pressures

One key program that Godongwana will struggle to cut is the payment of a 350 rand temporary monthly welfare grant, which was first introduced to cushion the vulnerable during the coronavirus pandemic. More than 8 million people receive the grant, and there’s a risk of social unrest should it be withdrawn. Two thirds of 12 economist surveyed expect the stipend to be extended by a year, and the balance see it being paid indefinitely.

What Bloomberg Economics Says...

“The upcoming elections and consideration of the potentially harmful effect of spending cuts on a weak economy are likely to keep the government’s adjustments to the budget modest.”

— Yvonne Mhango, Africa economist

State logistics company Transnet SOC Ltd., whose inability to provide adequate services is proving a major constraint on exports and economic growth, is also pressuring the Treasury to assume part of its 130 billion rand of debt — as it did for struggling power utility Eskom Holdings SOC Ltd.

The “government is struggling to take a proper hard stance on state-owned entities and they remain one of the biggest risks to our fiscus and credit ratings,” said Mike van der Westhuizen, a portfolio manager at Citadel Investment Services.

HSBC economist David Faulkner urged Godongwana to clearly spell out the budget trade-offs and policy choices that need to be taken to correct the country’s precarious fiscal position.

There’s been a lot of recent emphasis “around cost containment measures and spending cuts and ways to offset this increasing spending on government wages,” he said. “What’s done in the near term is going to be important.”

--With assistance from Colleen Goko.