CHICAGO--(BUSINESS WIRE)--Jun 14, 2023--

Following a year of economic uncertainty and market volatility, a new BDO survey finds that a significant number of tax practitioners have a more strategic role in their enterprises and a "seat at the table” when critical business decisions are being made.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230614638720/en/

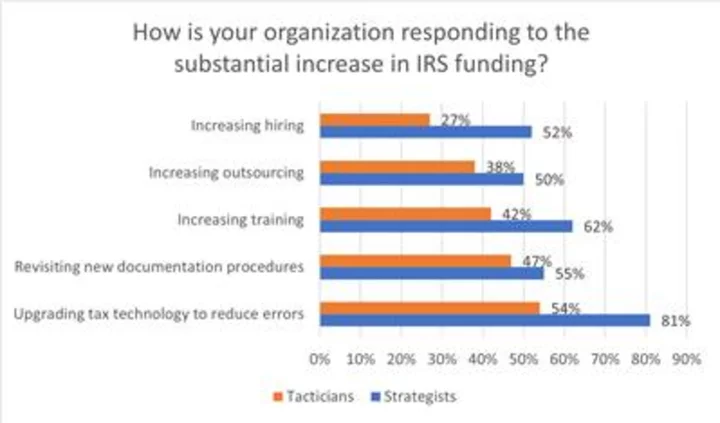

Strategic tax departments are more likely to say they are upgrading tax technology in response to the increase in IRS funding. (Graphic: Business Wire)

According to the 2023 BDO Tax Strategist Survey, released today, tax practices fall into two distinct groups – Strategists and Tacticians. BDO surveyed 150 tax executives and grouped respondents into two categories: Tax Strategists and Tax Tacticians, based on their level of involvement in key business areas, such as M&A, ESG, and economic resilience. Tax Strategists, which comprised 29% of all respondents, reported having greater involvement in business decision-making.

In some cases, Strategists and Tacticians have different expectations for the year ahead. For example, 64% of those classified as Tax Strategists say that their total tax liability will increase significantly in the next 12 months, compared to just 16% of Tacticians. With greater access to personnel, budget, technology, and data, as well as a deeper connection with key business decision-makers, Strategists have improved insight into where they are liable for tax and by how much.

“Tax Strategists know how to use all the tools at their disposal, including technology, talent, and external service providers to build a comprehensive understanding of their total tax liability in relation to their business’ operations. They can pull the right tax levers to get value for their business, while proactively managing cash flow and reducing risk. Taking a total tax approach allows them to serve as a strategic advisor to company leadership,” said Matthew Becker, Managing Partner of Tax, BDO USA.

Tax executives adjust to the new tax policy agendaand budgets

According to the survey findings, 37% of corporate tax executives expect the substantial increase in Internal Revenue Service (IRS) funding to be the most significant tax-related challenge their organizations will face over the next 12 months. Corporate tax departments are expecting more audits from the IRS as a result of their budget increase. While Strategists and Tacticians are both concerned about the implications, Strategists are preparing for more scrutiny.

With higher budgets and greater involvement in business strategy, Tax Strategists are more likely to have the necessary resources to prepare for increased scrutiny and are putting plans in place. Their plans include upgrading their technology, increasing employee training, and leveraging the right talent.

Strategists have the upper hand on tax technology

Tax Strategists are also more likely to have deployed, or plan to deploy, tax technology. Nearly two-thirds of Strategists already deploy bread-and-butter tax technology such as compliance and provision software. While Tax Strategists have an edge on Tacticians when it comes to technological maturity, they should not grow complacent. Tools can become obsolete or may not meet new challenges presented by evolving regulations. Strategists should be ready to continuously evolve.

Tacticians should start by assessing the organization’s technological maturity and defining future-state processes and technology goals. Calculating the cost and time savings of new technology can help make the case to leadership that additional investments are critical.

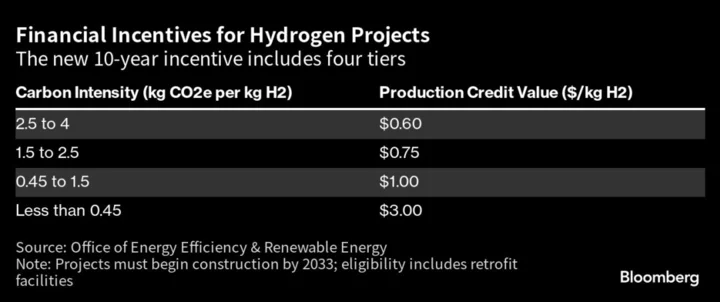

Aligning tax and ESG strategies

As ESG increasingly becomes a business mandate, tax leaders are aligning their tax strategy with the organization’s broader sustainability strategy. New sustainability-oriented tax credits create an opportunity for companies to support renewable energy advancement. Strategists are more likely to say their organization has a strong understanding of how tax intersects with ESG strategy. Eighty-four percent of Strategists agree with that statement compared to just 29% of Tacticians. Since Tax Strategists have more interaction and connectivity with operational leaders, they can champion the tax department’s role in broader ESG strategy.

Across tax strategy and policy, tax technology, and ESG, Tax Strategists are influential when it comes to helping their organizations build resilience and hone their competitive advantage. With increased collaboration across business units and an enhanced understanding of the triggers impacting their organization, Tax Tacticians can take a total tax approach to proactively manage tax implications and start to transform themselves into Strategists.

BDO’s latest survey provides a roadmap on how Tacticians can elevate their role to Strategist and earn a seat at the table: Download the full 2023 BDO Tax Strategist Survey report here.

About BDO USA

At BDO, our purpose is helping people thrive, every day. Together, we are focused on delivering exceptional and sustainable outcomes — for our people, our clients and our communities. Across the U.S., and in over 160 countries through our global organization, BDO professionals provide assurance, tax and advisory services for a diverse range of clients.

BDO is the brand name for the BDO network and for each of the BDO Member Firms. BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. www.bdo.com

View source version on businesswire.com:https://www.businesswire.com/news/home/20230614638720/en/

CONTACT: Anna St. Clair

The Bliss Group

646-576- 4114

astclair@theblissgrp.com

KEYWORD: UNITED STATES NORTH AMERICA ILLINOIS

INDUSTRY KEYWORD: CONSULTING ACCOUNTING PROFESSIONAL SERVICES FINANCE

SOURCE: BDO

Copyright Business Wire 2023.

PUB: 06/14/2023 09:04 AM/DISC: 06/14/2023 09:01 AM

http://www.businesswire.com/news/home/20230614638720/en