Tencent Holdings Ltd.’s revenue missed estimates, signaling an uneven recovery for the world’s biggest internet arena as it grapples with rising Chinese economic turbulence and anemic consumer sentiment.

Revenue rose a less-than-expected 11% to 149.2 billion yuan ($20.5 billion) for the three months ended June, after sales from major divisions including gaming and cloud services fell well short of analysts’ projections. Online advertising however surged 34%, in part because of algorithmic tweaks and a favorable comparison with the Covid trough of a year earlier.

Shares in major stockholders Prosus NV and Naspers Ltd. — proxies for the Chinese social media company — fell about 3%. The lackluster results cast doubt over a long-awaited comeback for an embattled sector whose leaders from Tencent to Alibaba Group Holding Ltd. barely grew in 2022. The WeChat operator, a barometer for the economy and industry through a business portfolio that spans gaming and social media to finance, had managed double-digit sales growth at the start of 2023.

Signs are mounting that the Chinese economy itself is faltering, a potent risk for Chinese tech leaders that traditionally rely heavily on the domestic market. Alibaba last week reported a better-than-expected 14% revenue rise for the June quarter as all its main divisions returned to growth, but warned of economic volatility ahead.

Read more: China Is Hiding More and More Data From the Rest of the World

Tencent’s net income rose 41% to 26.2 billion yuan in the second quarter, lagging the 32.3 billion yuan average estimate.

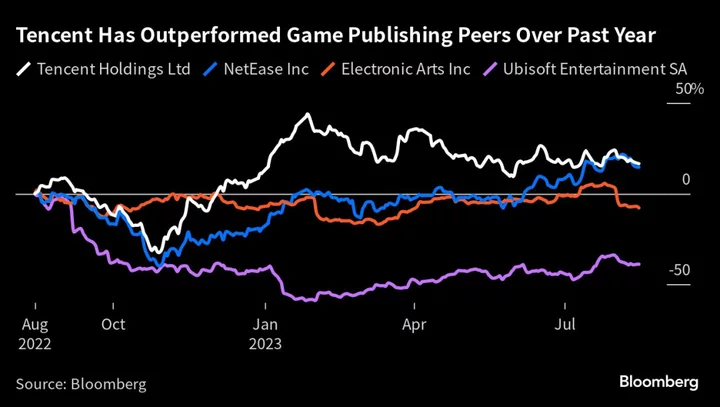

Tencent and Alibaba, the twin stars of a once-freewheeling industry, have gained some $50 billion of market value since May’s end, propelled by expectations of a gradual return to the consistent growth they enjoyed before Beijing clamped down on its biggest private corporations and richest entrepreneurs from 2020.

Keen to rejuvenate the world’s No. 2 economy, the government has in recent months signaled it’s ready to unfetter the sector and conclusively end an era of unpredictable diktats. That’s yet to translate into major policies, while Chinese consumer spending remains muted because of cloudy prospects for growth and employment.

What Bloomberg Intelligence Says

Rising macroeconomic uncertainty will likely drag on revenue growth though the latter half of the year, with rising cost pressures in games and AI capping the scope for further margin improvement. We expect 2Q revenue growth to be driven by a continued rebound in fintech, advertising and games revenue, with the top-line recovery set to continue through 2H23, albeit with reduced momentum. We expect management to provide an update on the self-developed Hunyuan foundation AI model, which recently entered testing. While this could catalyze some short-term investor interest, we view Tencent as a relative AI laggard and do not expect it to generate any meaningful revenue from AI over the next 12 months.

- Robert Lea and Tiffany Tam, analysts

Click here for the research.

Like Alibaba, Tencent faces foes on multiple fronts: old-time rivals like Baidu Inc. and Meituan are vying for dominance of the Chinese internet thanks to the emergence of generative AI. Baidu has so far stolen much of the limelight of the post-ChatGPT race, debuting Ernie Bot in March. Tencent finally said this month it’s testing its own large language model among employees.

Abroad, ByteDance Ltd. and PDD Holdings Inc. continue to make strides, building on expansions that began when Alibaba and Tencent were forced to show restraint. Despite rising geopolitical tensions, apps like TikTok and Temu offer a template for older peers seeking to regain pre-crackdown heights.

At home, the Chinese economy is worsening as Beijing grapples with property sector turmoil, rising debt and flagging domestic consumption.

To tide it over, Tencent is intent on reviving mainstay businesses like gaming and advertising, while continuing to push cost cuts. This summer, the world’s biggest game publisher debuted blockbusters Valorant and Lost Ark in its home market, filling a long-empty pipeline after censors resumed licensing approvals last year. Executives have declared Valorant its most important game of the year, as Tencent set aside more than $100 million for content and esports for the Riot Games shooter over the next three years.

Such new launches will test a rapidly saturating market, where younger players are increasingly drawn to anime games created by up-and-comers like Mihoyo Co. The maker of Genshin Impact just scored another hit with its April release of Honkai: Star Rail, which topped download charts in countries from China to Japan and the US.

Its international gaming revenue rose in the quarter while domestic sales plateaued, reflecting healthier spending abroad. Beijing this year moved to further limit time spent online by minors, adding to already strict gaming curbs.

The company recently added Polish zombie games maker Techland and Japanese publisher Visual Arts to its portfolio, part of a bigger drive to bring its tech and operation expertise to titles across genres and platforms.

Still, WeChat appears to be the more dependable bet for Tencent before its overseas gaming foray comes to fruition. The all-purpose app is credited with engineering a turnaround in ad sales, as it keeps rolling out new features to make users and marketers stay. But ByteDance’s Douyin is rapidly encroaching on WeChat’s territory, providing real-world services for things like food delivery and restaurant booking.

--With assistance from Jane Zhang, Sarah Zheng, Henry Ren and Mayumi Negishi.

(Updates with share action and breakdowns from the second paragraph)