Thailand is poised to leave its benchmark interest rate unchanged after eight successive quarter-point increases since last year that pushed inflation below central bank’s target even as economic growth remained dismal.

The Bank of Thailand will keep the one-day repurchase rate unchanged at 2.5% on Wednesday, all 22 economists surveyed by Bloomberg predict as the first hold decision in 17 months. The BOT will probably leave borrowing costs at a decade-high through the coming year, a separate Bloomberg poll showed.

The key rate has reached the neutral level and it’s time to hit the pause button on tightening, Governor Sethaput Suthiwartnarueput said days after the September rate hike that took the BOT’s cumulative tightening to 200 basis points. At that time, he expected the rate to stay at the current level “for a while” though economists are recently seeing rising odds of a rate cut next year.

“The BOT is likely to make its decision with a forward-looking lens,” said Erica Tay, an economist at Maybank Investment Banking Group. “Policymakers will appreciate the room to be able to cut next year should GDP growth disappoint due to unforeseen shocks.”

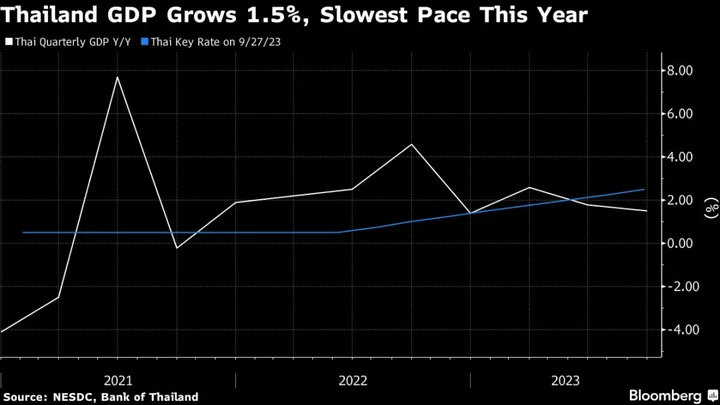

Thailand posted its first deflation since August 2021 in October and the slowest GDP growth this year in the third quarter, prompting Prime Minister Srettha Thavisin to say that the economy was in a “crisis.”

The premier has been pushing for a $14 billion cash handout program to end a cycle of low growth, aiming for annual GDP expansion of 5% during his term.

Here’s what to watch out for in the BOT statement at 2 p.m. local time:

Economic Outlook

The central bank, which repeatedly said that economic recovery is on track, will also review its growth and inflation estimates on Wednesday. It will likely revise GDP growth forecasts of 2.8% this year and 4.4% next year.

Economists have cut their GDP outlook and now see 2023 expansion at 2.5% from 3.3% previously and 2024 growth at 3.5% from a prior 3.6% estimate, according to the latest Bloomberg survey. They also revised down their inflation forecasts for this year and next.

Srettha’s stimulus measures were opposed by some central bankers including Sethaput, saying they could stoke inflation and widen the budget deficit. The BOT governor on Tuesday said consumer prices would have risen 0.9% last month instead of falling 0.31% had it not been for government subsidies.

Earlier this month, a top aide of the premier, Prommin Lertsuridej, had said the BOT’s rate increases contributed to the crisis.

Policy Direction

Market participants will closely monitor the central bank’s language to gauge the path of monetary policy. In the minutes of its September decision, the Monetary Policy Committee deemed the current interest rate as “appropriate” to support long-term growth, while flagging the government’s economic policies as a risk to borrowing costs.

The baht’s volatility has risen to 8%-9% this year, higher than pre-pandemic levels, Sethaput said on Tuesday. Still, the local currency gained almost 3% this month, among the best performers in Southeast Asia.

--With assistance from Cynthia Li.