When China’s Vital Materials Co. bought up a $600 million stockpile of obscure critical minerals in early 2020, it barely raised an eyebrow outside the niche world of minor metals.

Spin forward a few years, and the influence of a company some people in the industry have still barely heard of is a timely illustration of the scale of the challenge to loosen China’s grip on what have become key raw materials.

As the US and Europe rush to secure supplies to underpin their push into green technology, China has control over so many key elements, from lithium and cobalt used in batteries for electric vehicles to rare earth metals needed for high-strength magnets in wind turbines. Vital dominates the market for a range of so-called minor metals that feature majorly in lists of critical minerals published by the US, European Union, UK and Australia.

The company holds the biggest share of the markets for selenium, tellurium, indium and bismuth, which are used in solar energy, flat-screen televisions and pharmaceuticals, according to people familiar with the matter. It places in the top three for gallium and germanium found in touch-screen phones, satellites, and high-end semiconductors.

Unlike rare earth metals production, where China reigns supreme, their minor cousins are often by-products of mining industrial metals like copper and zinc and are typically then sent to Chinese companies for refining.

According to EU analysis, China is responsible for refining 94% of the world’s gallium and 83% of its germanium, giving it an even tighter grip on supply than it has for lithium and cobalt, where it accounts for up to 60% of global production.

That’s how Vital has lived up to its name. The company doesn’t mine the elements itself, it refines them at about two dozen facilities globally. And if you want to reduce dependency on China, then you first have to look at how the company operates, said Olimpia Pilch, chief operating officer at the Critical Minerals International Alliance in London.

“Within the various corners of the critical minerals industry you’ll find companies like Vital that have flown under the radar for a long time,” said Pilch. “If we don’t even know who these players are, then how are we going to create the right policies to build up new diversified industrial supply chains.”

Concerns about reliance on Chinese suppliers of critical minerals is now more acute after Beijing curbed exports of gallium and germanium earlier this month and as prices spike. The race is on to develop alternative sources overseas.

Vital’s quiet and steady march to dominance over the past three decades can offer its western rivals a blueprint for success, but it also reveals the commercial, political and technical hurdles that they will face along the way.

People familiar with its business, as well as long-time competitors and customers of the privately owned company, say its growth and success is largely down to its founder, Zhu Shihui, who is known as George Zhu outside of China. The 56-year-old entrepreneur has been willing to take big risks in highly volatile markets. That makes it tough for a rival in Europe or the US to emulate.

Between October 2019 and January 2020, Vital bought up a vast stockpile of metals that are indispensable to the electronics industry from a Chinese commodities exchange called Fanya that collapsed because of a financial scandal. Buying the stockpile allowed Vital to mop up raw materials that might otherwise have flooded on to global markets, while also providing a buffer against unforeseen supply shocks.

“We view the Fanya inventory as a unique surface mine that gives us tools to stabilize our supply chain and control volatility,” Zhu said in an interview. “It’s a unique strength, particularly in strategic industries that are very sensitive to cost.”

Zhu founded Vital in 1995 after spotting an opportunity. He’d previously been working for Japanese conglomerate Sumitomo Corp. in Guangdong, where he’d specialized in trading selenium, a low-value byproduct of the copper smelting process. At the time it was mainly used in glass-making and metallurgy, and he could see that orders were starting to boom in the early stages of China’s industrial expansion.

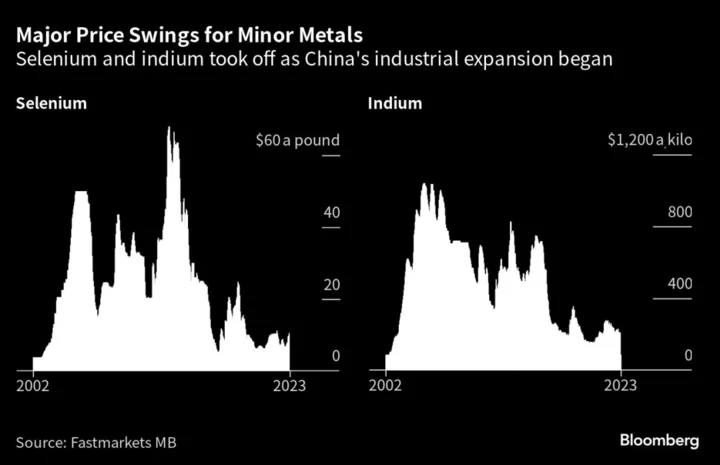

Selenium prices had been in the doldrums for decades, but by the early 2000s Chinese smelters couldn’t keep up with demand and prices started to skyrocket, along with other byproducts like indium and gallium that were finding new uses in technologies such as flat-panel TV screens and LED light bulbs. As Vital went overseas looking for more, prices started whipsawing as smelters raced to ramp up output.

“He has some gambling mentality for sure,” said Matthias Rueth, managing director at Tradium, a minor metals trading house in Germany. “He’s certainly for these products very active, very successful — and quite big.”

The extreme volatility would become commonplace across minor metals markets, and pose huge risks to refiners like Vital. Scooping up stocks when prices were low could bring major rewards by providing a buffer against future shortages, but the wild volatility of the early 2000s left Zhu wanting to get a much firmer grip on his supply chain.

“I came into this business naturally because at the time China was very reliant on imported supplies, and I saw that there were many areas of China's industrial supply chain that were going to need to be developed,” he said. “I have the same mentality now and I’m very different from a pure trader. We are not looking to make short-term gains — we are looking for more long-term sustainable growth.”

Zhu courted global copper producers for tellurium and selenium, aluminum producers for gallium, and zinc producers for indium. China’s vast coal industry yielded a uniquely rich supply of germanium, which is otherwise only found in minuscule concentrations in zinc deposits.

QuicktakeWhy the Fight for ‘Critical Minerals’ Is Heating Up

Already, China’s new export controls have sparked a fresh hunt to exploit mineral reserves of gallium and germanium in the US, Congo and elsewhere. With governments pledging support for those efforts, there’s a growing expectation that miners and refiners in the US and Europe will be looking more closely at the critical byproducts in their portfolio. “We’ve seen time and again in these markets that the tap can get turned off very suddenly and then everyone panics,” said Sarah Gordon, CEO and co-founder of risk management consultancy Satarla in London. “But it’s going to take a lot of courage to do something about it, given that it will be hugely expensive and risky to shore up these supply chains.”

The first challenge, though, is size. Large international mining companies will look at producing minor metals only then to see that money is better spent digging more copper or iron ore out of the ground, according to Todd Malan, a former government-relations executive at Rio Tinto Group, one of the world’s largest miners. He pointed to Pilbara iron ore mines in Western Australia.

“I’d call the problem the tyranny of scale,” said Malan, who is now chief external affairs officer at US nickel miner Talon Metals. “If you look at the internal rate of return of an iron ore mining project in the Pilbara, nothing compares to it and by comparison everything else looks small and not worth the effort, but that has to change.”

Then there’s ensuring enough purity when refining raw materials for use in high-tech industries where even the smallest traces of contaminants can wreak havoc in production processes. It’s in the complex refining process that Vital has gained a major competitive advantage.

The company spent years investing in research and development and working closely with customers to create a formidable catalog of highly specialized products, including about 80 high-purity metals and chemicals, as well as chemical gases, semiconductor substrates, optical lenses and ceramics that have an array of uses in advanced electronics and defense.

Read More: Chinese Company Swoops on Giant Stock of Metals Coveted by Trump What Are Gallium and Germanium? Niche Metals Hit by China Curbs

Advancing into those high-tech sectors became a key focus for Zhu when he built a sprawling new industrial base in Guangdong in 2012. As well as new labs, production lines and accommodation for his workers, Zhu also established a university-level campus and hired some of the industry’s most prominent researchers to train up his staff.

“These refiners and processors are very high-risk companies in terms of the supply and demand dynamics that they’re exposed to, and what they’re offering is a very specialist skillset that they have to hope no-one else will develop,” said Gordon, the ceo of Satarla.

Today, Vital employs more than 6,000 people at 16 plants in China and several other overseas facilities overseas. It has eight additional projects under construction in China, adding another 2,000 people. The company, whose revenue was $2.3 billion last year, has been growing at a compound annual rate of between 10% and 30% for the past decade, according to people familiar with the matter. Zhu declined to comment specifically on the company’s market position and its financial performance.

There are Western refiners that can compete with Vital’s technical prowess. Many, though, have suffered during the minor metals industry’s wild price swings while Vital ended up profiting from them. As well as scooping up excess inventory when prices slumped, Vital acquired some struggling competitors to expand internationally.

The acquisition of the Fanya exchange stockpile in 2020 was a prime example of Zhu’s tolerance for risk. When the bourse collapsed amid fraud allegations in 2015, the industry feared prices would crash as the metal swamped global markets. Now, the worry is that minor metals will spike as supply from China is choked off. For Vital — which already derives about half of its revenues from its international operations — the decoupling of global supply chains could set the stage for further growth.

“We see that there are opportunities for us to address the concerns of overseas players who don't want to have too much reliance on China,” Zhu said. “I understand their concerns, and we’re taking the opportunity to work with customers to proactively diversify their supply chains, because we're international players.”

--With assistance from Eddie Spence and Winnie Zhu.