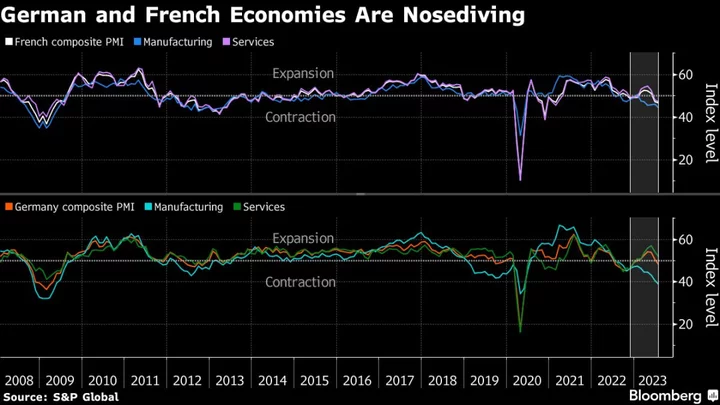

Germany and France kicked off the third quarter with contractions in their private-sector economies, with sustained weakness in manufacturing seeing increased spillover to services.

S&P Global’s Flash Purchasing Managers’ Index for Germany dropped to the lowest level this year, with a July reading of 48.3 that fell below the 50 threshold that indicates growth. France fared even worse, hitting a 32-month low of 46.6. The figures for both countries were worse than predicted by any economist in Bloomberg surveys.

In Germany, the negative reading was driven by manufacturing, which has been below 50 for more than a year and is now near levels last seen at the start of the pandemic in 2020. Growth in services slowed for a second month.

“There is an increased probability that the economy will be in recession in the second half of the year,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said of Germany. “Over the last few months, we have seen a jaw dropping fall in both new orders and backlogs of work, which are now declining at their fastest rates since the initial Covid wave at the start of 2020. This doesn’t bode well for the rest of the year.”

In France, both manufacturing and services were in contraction again, though the former is in worse shape of the two.

“The data signal a noticeable cooldown of the economy, showing the sharpest reduction of business activity since November 2020, which preceded a contraction in GDP” in France, said Norman Liebke, an economist at Hamburg Commercial Bank.

The dire PMI readings for the euro area’s two biggest economies are a warning for the region as a whole, for which numbers due later on Monday will probably also show a private-sector contraction.

Data earlier showed a contraction in Australia and stable expansion in Japan, while the UK and US are both predicted to show solid growth for July.

--With assistance from Joel Rinneby and Mark Evans.