The slide in the yen isn’t over, despite expectations the dollar may not be quite so strong in coming months, said the top forecaster for the currency.

The yen will probably weaken to 152 against the dollar this year, and 155 in 2024, Tohru Sasaki, JPMorgan Chase & Co.’s head of Japan markets research, said in an interview. Even a potential abandonment of the Bank of Japan’s yield curve control policy this year will not provide much hope in the long-term, he said.

It remains difficult for the BOJ to hike policy rates or bring inflation down, which is undermining the yen, said Sasaki, the most-accurate forecaster in a Bloomberg survey for the dollar-yen rate last quarter. The yen this week touched a fresh 10-month low, prompting a warning from currency official Masato Kanda, who said Wednesday that authorities are prepared to take action if unstable moves continue.

“The yen is likely to be one of the weakest currencies even next year,” said Sasaki, a former trader at the BOJ who was involved in foreign-exchange intervention in the 1990s. “I’m not sure how we can get out of this situation,” he said.

Japan’s currency was trading at 147.55 against its US counterpart on Thursday afternoon in Tokyo, after touching the weakest level since November. It has inched toward 148 in recent days as dollar strength persists and robust economic data bolsters the case for the Federal Reserve maintaining a high policy rate.

Sasaki’s forecast for dollar-yen is higher than the median of analysts surveyed by Bloomberg, who see the yen at 140 in the fourth quarter and 129 next year. He recommends shorting the yen against some major currencies, including the dollar, predicting that multiple cross-yen pairs will see even higher levels next year.

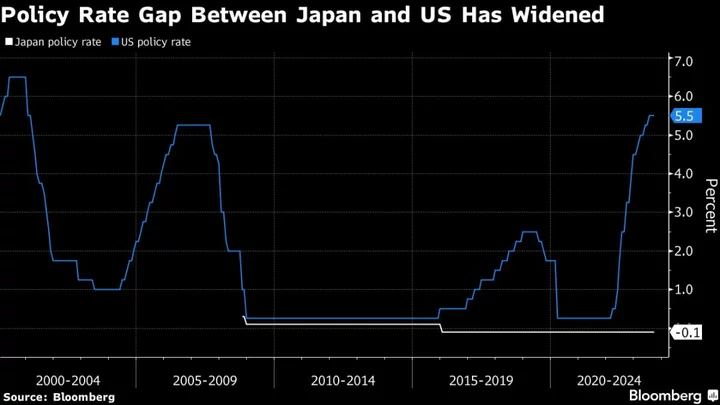

The yen has weakened against all of its Group-of-10 counterparts this year, as the BOJ stuck with its dovish stance while other central banks ramped up their rate hikes. Japan’s policy rate has been at -0.1% since 2016, while its US counterpart currently stands at 5.5%.

“Japan’s negative policy rate is likely to remain relatively deep for a long time,” Sasaki said. “Maybe the BOJ needs to hike the policy rate without thinking of the other negative impacts on the economy. But that will cause the unpopularity of the Kishida cabinet, so it’s politically difficult.”

The Japanese government may not jump in and buy yen until it reaches 155, said Sasaki, noting that the currency has already gone through levels that prompted intervention last year.

“With a yen purchase intervention, they cannot fail. They need to use foreign reserves which are limited,” he said. “So I don’t think that they will do the yen purchase intervention so frequently.”