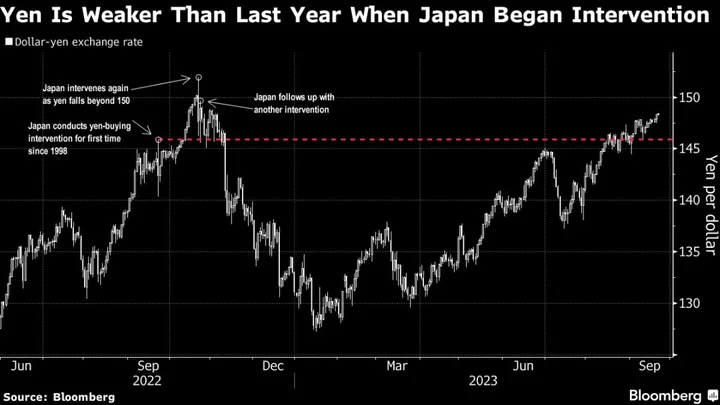

Traders are on guard for any sharp move in the yen as it hovers near the 150 level to dollar that some analysts consider to be a trigger for intervention by Japan.

The market is on tenterhooks ahead of the Bank of Japan’s policy decision on Friday, awaiting more detail from Governor Kazuo Ueda on the outlook for negative interest rates and his view on the yen’s weakness.

The currency appeared to be caught in limbo during Asian trading on Thursday, with the risk of intervention offering support while the widening yield gap with the US weighed against this.

The Federal Reserve signaled one more interest rate increase is likely this year — something that would further inflate the yield gap and hurt the yen. It touched 148.46 on Thursday, its weakest against the dollar since November last year, before strengthening slightly after Chief Cabinet Secretary Hirokazu Matsuno said Japan wouldn’t rule out any options to curb excessive moves.

It traded at 148.19 as of 5:29 p.m. in Tokyo.

Implied overnight volatility in the dollar-yen pair climbed the highest level since July 28, when the BOJ surprised the market by adjusting yield-curve control.

Japan’s top currency official, Masato Kanda, indicated on Wednesday that officials stand ready to intervene in the currency market, with possible US backing. US Treasury Secretary Janet Yellen said earlier that any intervention by Japan to prop up the yen would be understandable if it is aimed at smoothing out volatility.

“The yen weakened only moderately, as despite Janet Yellen’s commentary on Tuesday, Japan’s Ministry of Finance is likely to intervene in large fashion at 150 per dollar because it is hard to tolerate more inflationary pressure,” said John Vail, chief global strategist at Nikko Asset Management Co. in Tokyo.

The BOJ has maintained its ultra-loose monetary policy, including the world’s last negative interest rate, even as the nation’s inflation has stayed above its target of 2% for more than a year.

This keeps Japan’s sovereign debt yields lower compared with peers, weighing on the yen. It has lost almost 12% versus the dollar so far this year, making it the worst performance among major peers. The yield on benchmark 10-year government bonds in the Asian nation stood at 0.745%. While that’s the highest since 2013, it is a long way below the US equivalent of 4.42%.

“The sense of caution about the intervention is acting as a break for the yen’s weakness, which in turn reduces the risk of actual action,” said David Lu, director at NBC Financial Markets Asia Ltd. “However, there appear to be some yen long positions built on expectations of intervention. Unwinding of those positions may accelerate the pace of yen’s weakness, which could trigger an action.”

--With assistance from Daisuke Sakai.

(Adds latest prices. Note: A previous version of this story was corrected to show the 10-year JGB yield reached highest since 2013.)