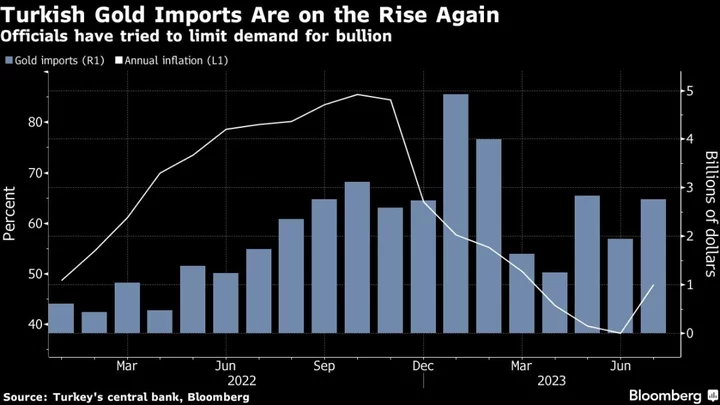

Turkey’s current account swung back to a deficit in July on the back of surging gold imports and a wider trade gap, after posting a rare surplus the previous month.

The shortfall was $5.5 billion, compared with a revised surplus of $651 million in June and a deficit of $3.5 billion in July 2022, according to central bank data published on Monday. The median estimate in a Bloomberg survey of analysts was for a gap of $4.5 billion in July.

A chronic imbalance in trade is a key vulnerability for the $900 billion economy that authorities want to overcome by reducing Turkey’s dependence on imports. Fresh economic targets unveiled by the government last week project the current-account deficit narrowing from about 4% of gross domestic product this year to 3.1% in 2024.

Since President Recep Tayyip Erdogan installed a new team to manage the economy after reelection in May, the goal has been to stabilize Turkey’s external finances by cooling off domestic demand with more orthodox measures such as higher interest rates and restrictions on gold imports.

The central bank has almost tripled its key interest rate to 25% since June, while the government announced a more realistic macroeconomic program that committed to reducing inflation and building back reserves.

Erdogan has said monetary tightening would be used to rein in high inflation, which the government sees finishing the year at 65%. The president’s comments mark a break with his earlier advocacy of cheap money at the expense of price stability.

A lasting improvement isn’t yet in sight for the current account, especially as demand for Turkish exports is sluggish and gold remains popular as a hedge against currency debasement. The trade shortfall in July was $10.5 billion.

A major factor behind the deterioration from June were wage hikes that drove up Turkey’s imports, according to a report from Goldman Sachs Group Inc. It also said that “a month of relative FX stability” meant purchases of foreign goods may have been “brought forward in expectations of future currency weakness.”

--With assistance from Joel Rinneby.