After eight months of deceleration, Turkish inflation probably ticked back up in July on the back of a string of tax hikes introduced to fix a swelling budget deficit.

Price growth accelerated to an annual 46.8% last month from 38.2% in June, according to the median forecast in a Bloomberg poll of economists.

Bloomberg survey participants see monthly price gains at 8.6%, the fastest rate since January 2022.

The government last month raised taxes on a variety of essential goods and fuel to repair public finances that deteriorated due to costly election pledges in the run-up to the May vote and financing needs after the February earthquakes.

In addition to those hikes, a depreciation in the lira and minimum-wage increases are expected to take effect to contribute to inflation’s ascending path, Bloomberg Economics’ Selva Bahar Baziki said, expecting an upward trajectory for the rest of the year. The lira has lost about 31% of its value against the dollar since the start of the year.

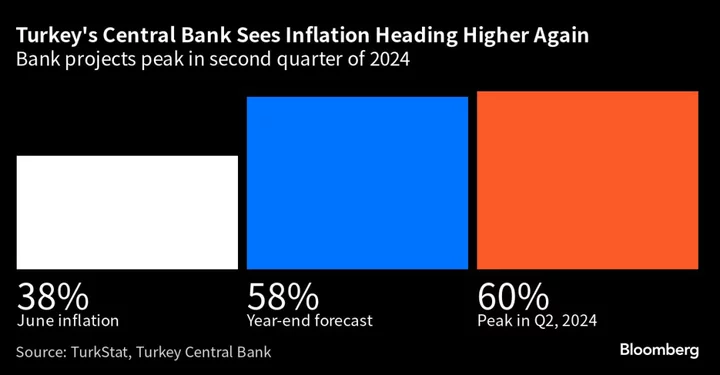

The central bank has acknowledged the inflationary impact from these raises in its quarterly inflation report presentation last week. Governor Hafize Gaye Erkan, in her first presentation since she assumed the role in June, more than doubled the year-end forecast to 58%.

She also said the bank expects inflation to peak at about 60% in the second quarter of next year.

Turkey watchers remain unconvinced that the current monetary policy — termed a gradual raising of interest rates by officials — will be able to tame the price gains. In two straight meetings, the central bank upped its benchmark rate by 900 basis points to 17.5%. Deutsche Bank thinks the central bank will move it to 19% this month.

When adjusted for inflation, that would put real rates still well below zero.

Read more: Inflation Accelerates in Turkey’s Biggest City After Tax Hikes

Erkan has said the tightening path will remain gradual so as to manage its impact on the real sector and the banking industry, and that alternative measures would be introduced to support policy.

The monetary authority and the banking regulator have taken some steps to curb domestic demand through measures aimed at cooling credit-card spending and consumer loan growth.

--With assistance from Harumi Ichikura.