United Arab Emirates-based banks are increasing loans to their Turkish counterparts, filling a gap left by Western lenders that have retreated amid concerns over the country’s increasingly restrictive regulatory environment under President Recep Tayyip Erdogan.

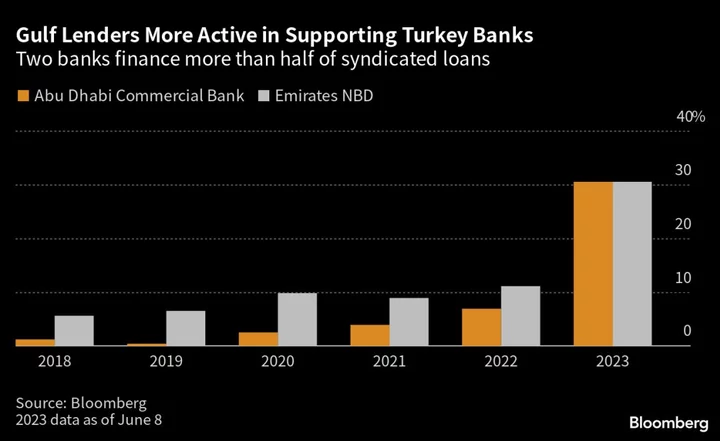

Two of the Gulf state’s biggest lenders, Abu Dhabi Commercial Bank PJSC and Emirates NBD Bank PJSC, arranged 61% of all syndicated loans, which involve multiple lenders and one borrower, to Turkish banks in the first half of the year, compared with about 15% during the same period a year earlier, according to data compiled by Bloomberg.

By comparison, the likes of ING Groep BV, Deutsche Bank AG, Citigroup Inc. and Standard Chartered Bank Plc — which have lent to Turkish banks every year since 2021 — arranged 18% of loans, down from 33% a year ago.

Many international banks turned increasingly cautious on Turkey in the run-up to crucial elections in May that saw Erdogan reelected for another five-year term. Although the president is now setting the stage for a change in economic course, he has long championed an unorthodox economic policy based on ultra-low interest rates, which has come at a high cost in the form of depleted foreign-currency reserves, an inflationary spike, and an exodus of foreign capital.

“Western lenders are wary about Turkey’s risk although there is no Turkish loan repayment problem,” said Batuhan Ozsahin, chief strategist at Istanbul-based brokerage Ata Invest. Gulf countries “are ready to take more Turkey risks and so we see them more in lending to Turkish syndicated borrowings.”

The UAE’s appetite for Turkish loans is also politically significant. Gulf countries have been improving ties with the country after a decade of frosty relations that rippled across the Middle East. This has led to a series of trade deals, currency swap agreements and investment in the country, including Emirates NBD’s acquisition of Denizbank AS in 2019.

Turkish banks “may have preferred GCC banking leads in recent syndications due to heightened trade and banking relations with those banks,“ said Pinar Uguroglu Delice, a banking analyst and head of equity research at BNP Paribas’ Turkey unit TEB Yatirim.

Despite the heightened interest from UAE lenders, foreign borrowing by Turkish banks is at an all-time low due to higher borrowing costs and weaker domestic demand for hard currencies. The amount of syndicated loans arranged this year dropped 55% to $2.9 billion from $6.4 billion a year earlier, according to the data.

With Erdogan indicating that he’ll give his new economic team more leeway in altering policy, which could open the way for a shift from years of unconventional measures, foreign investors may be drawn back into the country.

“Expected new economic reforms may change this trend, with the next round of syndications in the third and fourth quarters serving as a litmus test for foreign investors’ perception of risk in Turkey,” said Tomasz Noetzel, a senior emerging European banking analyst for Bloomberg Intelligence.

Author: Ercan Ersoy, Asli Kandemir and Jacqueline Poh