UBS Group AG’s decision last month to completely integrate Credit Suisse’s domestic business brings with it a task that’s notorious for running behind schedule and over budget. Just ask Deutsche Bank.

The Swiss lender must now figure out how to bring over some 1.5 million client accounts from Credit Suisse into its own IT framework. Depending on the state of the technology, the shift could cost UBS anything from $1 billion to $3 billion or more, according to to conversations with executives and informed experts familiar with the task.

UBS’s schedule, which targets the integration to be finished by the end of 2025, is very ambitious and not certain to be met, the people said, who asked not to be named discussing private details. The plan to bringing together the domestic banks’ infrastructure is part of UBS’s overarching goal to save more than $10 billion in costs from the historic merger.

There are no recent examples of a banking IT fusion at this scale to draw on, other than Deutsche Bank’s troubled integration of Postbank AG that kicked off after its full takeover in 2010. That shift, larger in scale, has occupied Deutsche Bank for more than a decade, showing how a systems overhaul can cost billions of dollars, tie up managers and back-office staff for years, sap investment in new products and even blight the company’s brand.

UBS declined to comment on the IT integration.

The technology conundrum for UBS speaks to one of the core challenges for the whole integration of Credit Suisse following the emergency takeover earlier this year — how to avoid having both rising costs and declining revenue from the defunct lender at the same time.

Deutsche Bank kicked off several failed efforts to first integrate and then carve out Postbank’s systems before ultimately deciding in 2019 to migrate all of the unit’s client data onto its own platform. The goal was to decommission Postbank’s entire IT and save hundreds of millions of dollars in annual spending by the end of 2022.

Yet the project soon suffered from heavy delays and budget overruns, and the bank has pushed out the promised savings to the end of 2025, three years behind plan. It recently declared the migration complete, only to suffer an avalanche of client complaints that has triggered a regulatory probe.

For UBS there’s an optimistic scenario. The migration for Credit Suisse’s domestic systems and clients can be kept in the $1 billion range if UBS can avoid having to reprogram everything from the start.

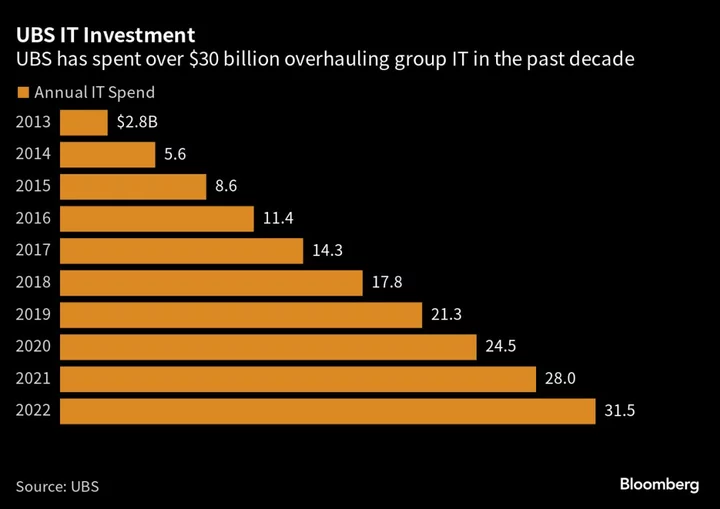

Chief Executive Officer Sergio Ermotti has a fighting chance of keeping the costs down partly because UBS has been spending several billions of dollars a year in the last decade to overhaul its IT.

But if Credit Suisse’s clients can’t easily be plugged into UBS’s, the price tag could easily swell to $3 billion or more, the people familiar with the matter said.

If the two banks’ IT systems are completely incompatible, that would require a full reprogramming — literally rewriting the code — of all the various technology that supports consumer loans, mortgages and other transactions. It can also mean reformatting the client data in the databases.

A lot can go wrong. Deutsche Bank’s digestion of its retail-focused domestic rival required shifting a vast amount of data with 12 million Postbank customers that was sometimes created over decades and reformatting it for its own systems.

Deutsche Bank faced unexpected problems such as reluctance among Postbank clients to sing the paperwork needed to move their data and fitting the diverging details for the other lender’s products into Deutsche Bank’s databases, other people familiar with the matter said. There were outages and problems with the mobile apps while call centers were overwhelmed with customers struggling with their accounts, they said.

A spokesman for Deutsche Bank declined to comment.

For Ermotti, avoiding those pitfalls may mean splurging on consultants now to help build technology bridges between the banks. A major cost in the process is building a temporary system to extract Credit Suisse data and file it into UBS servers, without the customer losing access to their bank account. That system can be as big as an existing IT framework for a bank.

“These are huge databases, resulting in a highly complex project, and the bank cannot risk losing customer data in the process,” Andreas Venditti, a banking analyst at Bank Vontobel AG in Zurich, said in an interview. “This is a huge task.”

Author: Marion Halftermeyer, Celia Bergin and Myriam Balezou