UK bankers paid thousands more in taxes last year, a development that drew warnings that the City of London’s status as a global financial center could be at risk.

The average tax collected per UK bank employee jumped by 11.2% in 2022 compared to the previous year, according to a survey of the banking sector by trade association UK Finance. The increases were largely due to the government’s policy of freezing income tax thresholds and a temporary increase in National Insurance contributions.

On average, the government now collects £42,420 in tax per bank employee across the whole sector, including income taxes and National Insurance contributions paid by employees, as well as other direct tax costs borne by the employer.

“The UK is currently on course to become a less competitive location for banks compared to other financial centers,” said Andy Wiggins, total tax contribution and tax transparency leader at the consultancy PwC, which conducted the survey for UK Finance as part of a report into the tax contribution of the UK banking sector.

As chancellor of the exchequer, UK Prime Minister Rishi Sunak froze income tax and national insurance thresholds in March 2021 until 2026. The policy was extended by current chancellor Jeremy Hunt until 2028. The UK’s opposition Labour Party has pledged to end the freeze.

The policy is known as fiscal drag, allowing the government to extract more revenue from taxes without a single policy change because when thresholds are frozen but pay goes up it pushes more people into higher tax bands. It’s been expected that the policy would have a much bigger impact this year as employers raise compensation to help their staff battle Britain’s acute cost-of-living crisis.

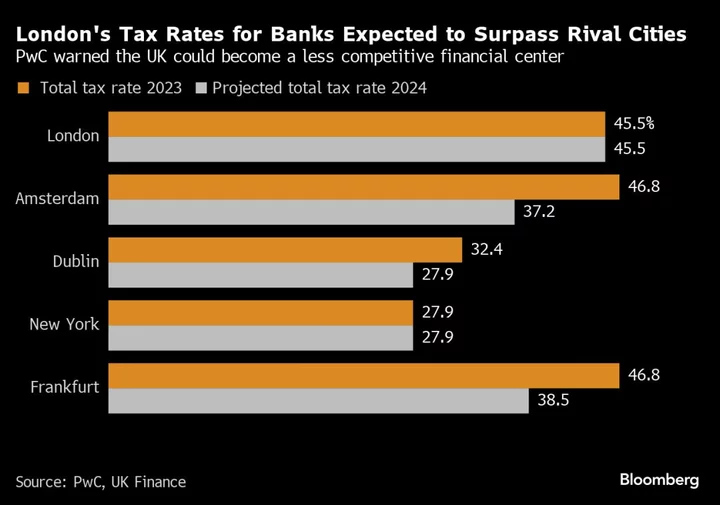

The report projects that the total tax rate for banks based in London will be 45.5% in 2024, higher than other major financial centers like Frankfurt, Amsterdam and New York. That figure accounts for all taxes affecting banks and their workers, including employee taxes, VAT and corporation taxes.

In New York, by comparison, the total tax rate for bank is projected to be 27.9% in 2024.

“The UK banking sector is at the heart of the economy and this study shows that its contribution to the public sector continues to be significant,” Wiggins said. “Maintaining the competitiveness of the sector at a time of heightened geopolitical and economic disruptions is important in fostering economic growth and promoting greater investment into the wider UK economy.”

(Updates with New York comparison in penultimate paragraph.)

Author: Conrad Quilty-Harper