Wealthy UK investors are buying up gilts at a frenetic pace to take advantage of tax perks and soaring yields.

There’s been an almost tenfold jump in direct bond trading year-to-date at Interactive Investor Ltd. compared with the same period in 2022, with nearly all the activity concentrated in gilts. It’s a change in strategy for investors, who typically get rates exposure via bond or money-market funds rather than buying the securities directly.

Yet for high earners, owning gilts comes with financial-planning benefits: they’re free from capital gains tax on any profits made when selling or redeeming the bond.

Read: Rare UK Inflation-Linked Bonds Reap Record £1.2 Billion Payout

Because taxes are still applied to income from coupons, notes with low coupons are especially attractive for these investors and short-maturity gilts are in particular demand, according to Interactive Investor, which has over £50 billion ($63 billion) of assets under administration.

“Cuts to the tax-free capital gains allowance are making gilts an even more effective way of reducing tax bills,” said Sam Benstead, a deputy collectives editor at Interactive Investor. The most popular bonds suggest “investors are holding the gilts to maturity, locking in yields of more than 5%,” he said.

Recession fears are also playing a role pointing investors toward the short end, where yields are juiciest.

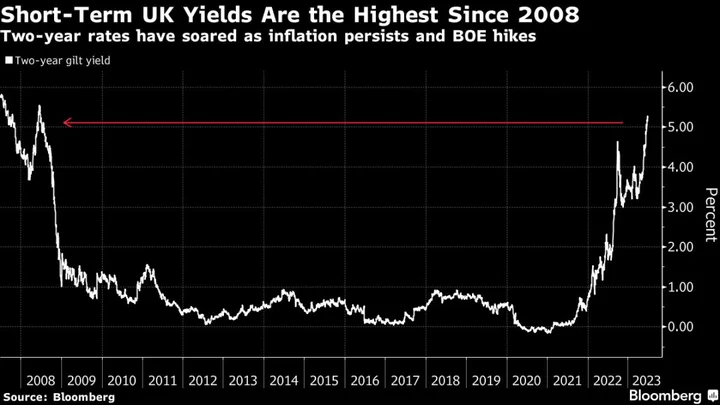

Expectations that the Bank of England can only tame inflation by pushing the economy into contraction with ever-higher interest rates has warped the bond market. Short-term yields are higher than those on 10-year debt by the most in more than two decades.

The yield on benchmark two-year bonds rose to as high as 5.33% this week, the highest since 2008. Even after a run of aggressive hikes by the BOE, traders see room for the key rate to go higher, peaking at around 6.25%, the highest since 1998.

Tax changes mean the bonds appeal to the highest earners above all.

Tax Opportunity

The threshold after which a UK taxpayer has to pay the capital gains levy is currently £6,000, down from £12,300 last year. It’s set to drop further to £3,000 from April next year. Once that ceiling is passed, the amount of tax an investor must pay is based how much they earn. Higher earners would typically pay 20% capital gains, but gilts are exempted.

Wealth manager RBC Brewin Dolphin estimated earlier this month that for an investor paying the highest tax rate, a UK gilt maturing in 2024 with a coupon of 0.125% equates to a net annual yield to redemption of 4.59%. To achieve that same yield on taxable savings, a savings account would need to pay interest above 8%, the research said.

“The window of opportunity to invest in gilts at a very attractive return remains open,” said Rob Burgeman, senior investment manager at the firm. “Inflation has been a stickier issue than first thought and interest rates look like rising again before the BOE even thinks about reducing them.”

While the most popular gilts are those with short maturities, one bond maturing in 2061 has also attracted interest from private investors on the Interactive Investor platform. First issued in 2020 when rates were rock-bottom, its coupon is only half a percentage point and the bond currently trades at 32 pence.

“The popularity of this bond suggests that some investors could be betting that interest rates will fall faster than the markets expect and hope to sell the gilt for a capital gain before it matures,” said Interactive Investor’s Benstead. “This is also tax free.”