Britain’s economic growth will fall further behind the euro area next year, and inflation will remain stubbornly high, according to new forecasts that paint a bleak backdrop for the next general election.

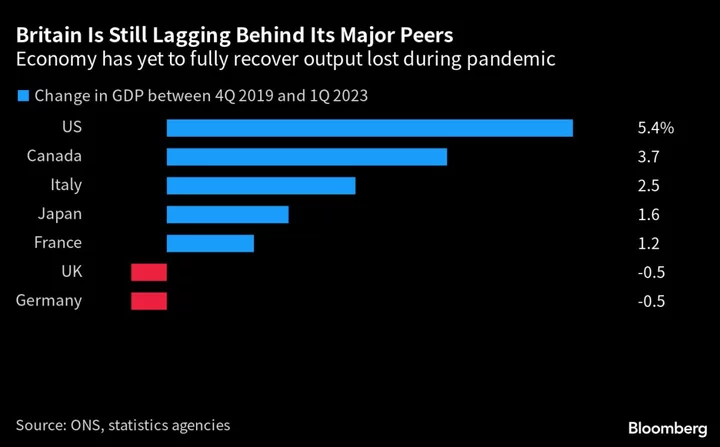

Gross domestic product is expected to grow by 0.6% in 2024, well below the 1% gain anticipated in the euro area, a monthly survey of economists by Bloomberg showed. The UK figure was revised down by 0.3 percentage points from the last reading, the biggest change in the poll. This year may deliver a meager 0.2% growth.

While some economists, including Bloomberg’s own analysts, have raised the specter of a potential recession this year, most surveyed still expect the UK to avoid a prolonged contraction. Still, they see a deteriorating outlook and stagnation through 2024, which will do little to support Prime Minister Rishi Sunak’s bid to win an election that must be held by early 2025.

Confidence has dropped sharply among the chief financial officers of some of the UK’s biggest listed companies. A net balance of 10% of CFOs surveyed by Deloitte were less optimistic about their businesses’ financial prospects than three months ago, down from a balance of 25% who were more optimistic in the first quarter.

Both the Conservative government and Labour opposition will put the the economy at the center of their election campaigns in an attempt to win over beleaguered households and businesses. The Conservatives currently have just 25% of the vote compared to Labour’s 43%, according to the latest YouGov/Times poll.

The Confederation of British Industry waded into the debate in a report on Monday suggesting that green growth — projects to move the UK away from fossil fuels and toward clean energy — could deliver a £57 billion ($74.7 billion) boost to GDP by 2030, equivalent to between 1.6% and 2.4% of GDP.

“All parties should be on red alert for green growth and put it at the very heart of their manifestos,” said CBI Director-General Rain Newton-Smith. “Not only does it offer hope for lifting the current economic gloom, but it can deliver a path to sustained growth for years to come.”

While the UK struggles to build any momentum, the euro area is expected to grow by 0.5% this year and 1% next, as strong rebounds from France, Italy and Spain — and Germany in 2024 — help boost the bloc’s performance, according to the Bloomberg survey.

Inflation expectations for the UK were also revised up more than for any other major European economy. Economists expect Sunak will hit his target of halving inflation by the end of the year, but they are now predicting that rate for the fourth quarter will be 4.8%, up from 4.6% previously.

Inflation will remain above the Bank of England’s 2% target for the entirety of next year, they said, only falling back to that level in 2025.

Forecasts in the survey are more optimistic than analysis by Bloomberg Economics, which along with a handful of other economists says the risk of a recession is rising with a jump in interest rates.

“We think the economy will probably stagnate over the second quarter,” Dan Hanson and Ana Andrade at Bloomberg Economics wrote in a note. “Further declines in output are likely over the first three quarters of 2024.”

The combination of high inflation, sputtering growth and tensions left over from the UK’s decision to leave the European Union has held back business investment. Higher inflation is also raising the cost of borrowing, with the Bank of England expected to lift its benchmark lending rate through the summer from the current 5%. Economists expect a rates to peak at 5.75%, while investors are betting the figure is over 6%.

Fears are growing that Sunak’s plan to prop up the UK economy are too thin on detail, with US economist Tyler Cowen warning an audience in Westminster last week of a “blown opportunity” if the government did not intensify its focus on growth.

Former Prime Minister Liz Truss, who was ousted from the role last year after just 49 days, claimed at the same event marking the launch of her Growth Commission task-force that the UK was in a “boiling frog situation.”

“After escaping a recession in the first half of 2023, the UK’s luck may be running out of steam,” said Sanjay Raja, senior economist at Deutsche Bank. “Higher rate expectations amidst still stubborn inflation will continue to hit households and businesses.”

Separate research published today revealed that rocketing interest rates have triggered the biggest plunge in UK household wealth since World War II. The Resolution Foundation said household wealth tumbled by £2.1 trillion ($2.8 trillion) after a slump in bond prices reduced the value of pension assets.

“Over the past four decades wealth has soared across Britain, even when wages and incomes have stagnated,” said Ian Mulheirn, research associate at the Resolution Foundation. “Rapid interest-rate rises have ended this boom and brought about the biggest fall in wealth since the war.”

Read more:

- England’s Falling Job Advertisements Ring a Recession Alarm

- UK Fiscal Watchdog Says Debt ‘Unsustainable’ and Deteriorating

- Hot UK Wage Data Keeps Spotlight on Bank of England Rate Hikes

- Labour Invites Tory Donors to Breakfast in Bid to Woo City Elite

- UK CPI Inflation Is Proving Persistent, 2023 Drop Still Likely

--With assistance from Harumi Ichikura and Andrew Atkinson.

Author: Lucy White, Tom Rees and Irina Anghel