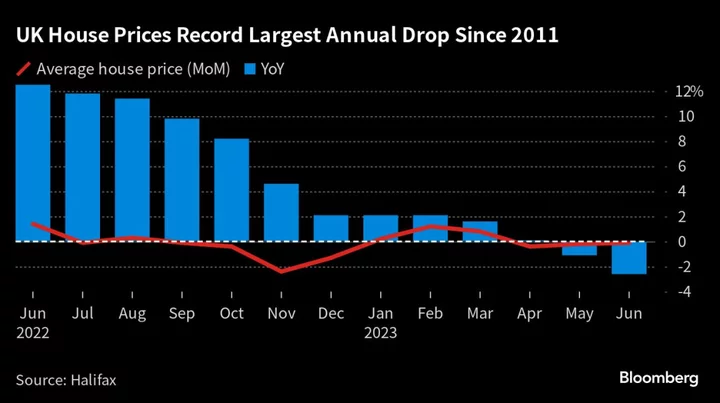

UK house prices are falling at their fastest annual pace since 2011, Halifax said, as the property market buckles in the face of rising borrowing costs.

The average cost of a home declined 2.6% in June from a year earlier to £285,932 ($364,320), the mortgage lender said in a statement Friday. Prices fell 0.1% last month alone, the third consecutive decline.

Speculation the Bank of England will have to keep raising interest rates to tame inflation has pushed up the cost of mortgages, with the most common fixed-rate loans now above 6%, a level seen as a pain threshold for consumers.

“The resulting squeeze on affordability will inevitably act as a brake on demand, as buyers consider what they can realistically afford to offer,” said Kim Kinnaird, director at Halifax Mortgages.

In a further blow to homeowners, traders are now pricing in the BOE raising interest rates to 6.5% by December, the highest level since 1998.

For many, the surge in borrowing costs has yet to hit home. Industry body UK Finance estimates 800,000 fixed-rate loans will need to be refinanced in the second half of this year, and a further 1.6 million in 2024.

A picture of a cooling housing markets also emerged last week in data from Nationwide Building Society, whose own house price index showed a 3.5% decline on the year — the most since 2009.