The downturn gripping the UK housing market steepened in August as the cost-of-borrowing squeeze sapped demand, according to a major mortgage lender.

Nationwide Building Society said the average cost of a home fell 5.3% in August from its peak in the year ago, the fastest pace since July 2009 when the global financial crisis was raging. That put values at £259,153 ($328,020), down £14,600 from August 2022.

The figures indicate the market is now half way through the 10% slump in prices that economists have forecast after 14 consecutive interest-rate increases from the Bank of England. It highlights a risk to Prime Minister Rishi Sunak’s government as it prepares for an election widely expected next year.

Falling prices are unsettling property owners, who have grown accustom to steady increases over the past decade. Landlords have started selling their holdings, exacerbating a shortage in the places available to rent. Economists say the downturn is likely to intensify in the second half of this year.

“The impact of past rises in interest rates is building,” said Martin Beck, chief economic adviser to the EY Item Club. He expects a “slow puncture than a serious correction in house prices.”

Policy makers are seeking to tame inflation, adding to the strains on consumer pockets. While mortgage rates are beginning to edge lower, borrowing costs for households remain far higher than they were a year ago.

“The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels,” Nationwide Chief Economist Robert Gardner said in a report Friday.

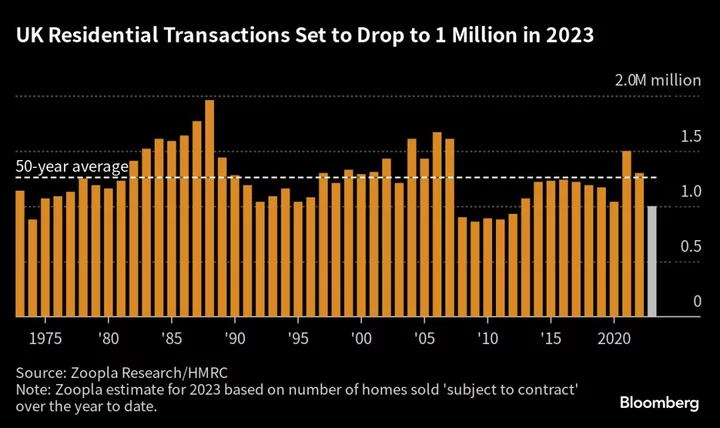

The figures add to a picture of wilting demand for property. BOE data show mortgage approvals fell almost 10% in July, and property portal Zoopla said this week that home sales are on track to drop to the lowest level since 2012.

House prices peaked in August last year following a pandemic-driven boom. They have fallen in 10 of the 12 months since then as rising rates piled further pressure on households already struggling with the spiraling cost of energy, food and other everyday goods.

“We think house prices will have further to fall a little bit further to bring demand back in line with supply,” said Pantheon Macroeconomics’s senior UK economist, Gabriella Dickens.

What Bloomberg Economics Says ...

“Britain’s housing market correction is set to continue. The latest UK Nationwide house price index shows home values are falling at their fastest annual pace since 2009 under the weight of higher interest rates.”

—Niraj Shah, Bloomberg Economics. Click for the REACT.

Even if the base rate tops out at 5.5%, after one more quarter-point hike, a typical two-buyer household would likely still see mortgage repayments absorbing around 28% of their incomes, she said — well above the 20% average in the 2010s.

The Nationwide report also showed evidence that the volume of sales is slowing sharply. A measure of housing transactions completed fell almost 20% below 2019 levels and 40% under where they were in the first half of 2021.

The number of completions by people moving homes with an existing mortgage fell by a third from 2019 levels in the first half. First-time buyer transactions were down by 25%. Buy-to-let purchases involving a mortgage were almost 30% below pre-pandemic levels, indicating a slowdown as landlords struggle to afford rising debt servicing costs.

“There are signs that buyers are looking towards smaller, less expensive properties, with flats seeing a smaller decline,” said Gardner.

Bank of England Chief Economist Huw Pill on Thursday gave some hope to prospective buyers, as he indicated that the fastest monetary-tightening cycle since the 1980s may be coming to an end. However, rates, currently 5.25%, were unlikely to fall anytime soon as officials maintain their battle against an inflation rate that remains three times above target, he warned.

A preference for fixed-rate mortgages in recent years means millions have yet to feel the effect of higher interest rates. As those deals expire, they will see their monthly bills jump by £220 on average, according to a survey last week that found one in three homeowners are taking on extra work to shore up their finances.

House prices have nonetheless avoided the collapse that appeared possible last autumn, when then-Prime Minister Liz Truss’s ill-fated budget sent borrowing costs soaring. In November, Nationwide warned of a potential 30% drop in prices in a worst-case scenario.

Bloomberg Economics and EY expect a peak-to-trough decline of around 10%. That’s half the loss they suffered between late 2007 and early 2009, after the collapse of mortgage lender Northern Rock marked the start of the financial crisis in the UK.

Read more:

- BOE Chief Economist Favors ‘Table Mountain’ Path for Rate

- UK Property Sellers Cut Asking Prices at Sharpest Pace This Year

- UK Buy-to-Let Mortgages Sliding Into Arrears Surge by Almost 30%

(Updates with comment and political context.)