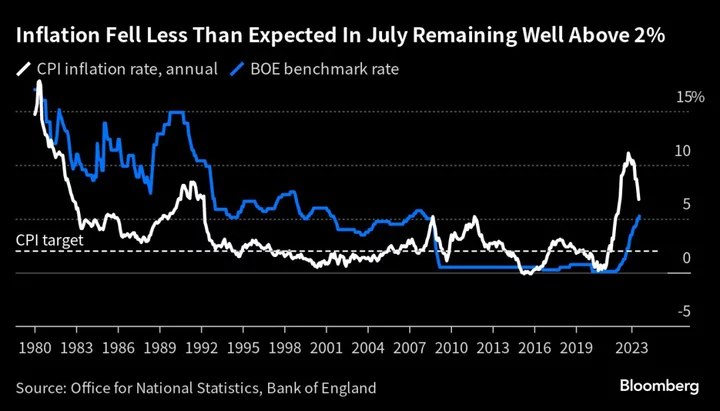

UK inflation remained higher than expected last month, adding to the case for the Bank of England to raise interest rates again.

The Consumer Prices Index rose 6.8% in July, slower than the 7.9% increase the month before, the Office for National Statistics said Wednesday. It exceeded the 6.7% rate economists had expected, the fifth time in six months the figures surprised on the upside.

The core rate of inflation, excluding food and energy prices, held at 6.9% in July instead of ticking down as economists had expected. Energy and food helped bring the headline inflation rate lower, but transportation costs were rising.

Coupled with a record surge in wages reported on Tuesday, the figures strengthen the sense that Britain is suffering the worst inflationary spiral in the Group of Seven nations. Investors have revived speculation the BOE will deliver a quarter point rate hike or more next month.

The pound extended gains after the release, rising 0.2% to $1.2731.

Britain has suffered the worst inflation in the Group of Seven since the start of the pandemic after an energy crisis that struck across Europe and US levels of people dropping out of the workforce. The latest inflation figures were 5.3% in the euro area, 3.2% in the US and 3.3% in Japan.

--With assistance from Alex Mortimer.

Author: Lucy White, Philip Aldrick and Eamon Akil Farhat