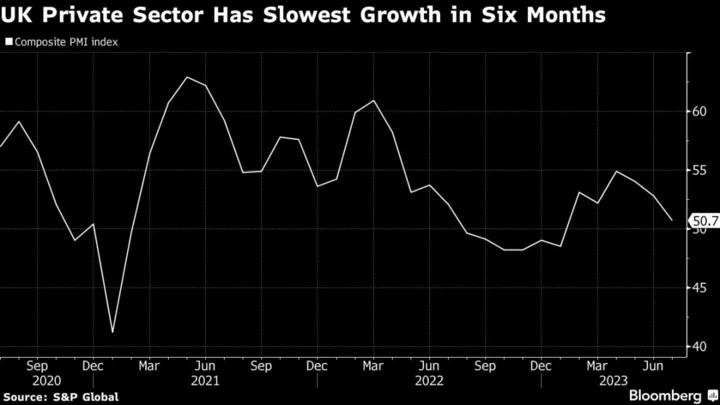

British companies reported their slowest growth in six months as new orders stalled and upward pressure on prices eased, suggesting that a jump in interest rates is starting to bite.

S&P Global Market Intelligence said its index tracking sentiment among purchasing managers fell to 50.7 in July from 52.8 the month before. Economists had expected little change. Manufacturing hit the lowest in 38 months, and respondents pointed out more caution among clients.

The figures indicate a slowdown for the UK economy later this year after the quickest series of interest-rate increases in three decades from the Bank of England. The central bank is trying to cool the economy and inflationary pressures that remain the worst in the Group of Seven nations.

“Rising interest rates and the higher cost of living appear to be taking an increased toll on households, dampening a post-pandemic rebound in spending on leisure activities,” Chris Williamson, chief business economist at S&P Global, said in a statement Monday.

The pound fell and gilts rallied after the report. The UK currency fell 0.3% against the dollar to $1.2810 and by 0.2% vs the euro. The yield on 10-year notes fell 9 basis points to about 4.19%.

What Bloomberg Economics Says ...

“Momentum is ebbing in the face of higher interest rates. We think Britain will slip into a one-year long recession later in 2023. The Bank of England’s August policy decision is set to be a close call between a 25 basis-point and 50-bp hike. The PMI decline could help tip the balance toward a smaller move.”

—Ana Andrade, Bloomberg Economics. Click for the REACT.

This month’s composite index, which includes both services and manufacturing, remained above the threshold of 50 indicating an expansion. The manufacturing PMI dropped to 45 this month from 46.5 in June, showing a sharper contraction.

Williamson said forward-looking indicators including new orders and future business expectations all point to growth weakening.

Britain’s economy so far has held up better than expected to higher borrowing costs and the tightest cost-of-living squeeze in generations, avoiding a recession that many including the BOE had predicted for this year.

Official data showed wages have risen more than anticipated in recent months, and retail sales were above forecast. A survey from Adzuma published Monday showed job vacancies rising in each of the past five months.

S&P’s report paints a much bleaker picture, showing activity in the dominant services sector growing at the slowest pace in six months. It was the third consecutive slowdown, and a number of companies cited concerns about the property market.

Those factors are also starting to take some of the wind out of inflation, which will be a relief for BOE policy makers led by Governor Andrew Bailey. Investors are betting on another rate hike next week.

“Although ongoing upward wage pressures mean service sector price growth remains elevated, the survey data signal further, potentially marked, falls in consumer price inflation in the months ahead,” Williamson said.

--With assistance from Greg Ritchie.

(Updates with market reaction.)