UK retailers reported sluggish sales in September as squeezed consumers cut back on big-ticket spending and unseasonably warm weather delayed purchases of winter clothing.

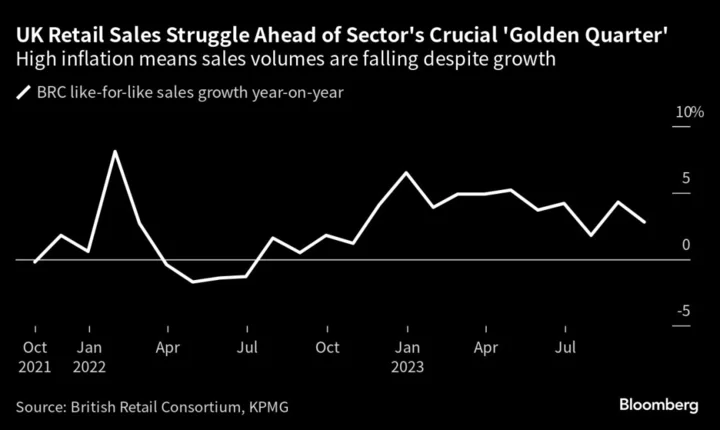

The amount of money spent in stores climbed 2.7% compared with a year ago, a slowdown from 4.1% growth in August, according to a survey by the British Retail Consortium and KPMG.

It was the second-weakest month of the year so far and well below the rate of inflation, meaning the volume of goods sold fell. On a like-for-like basis, sales values were up 2.8%.

The figures will add to concerns that the UK economy is heading into a rocky end to 2023 as higher interest rates eat into household budgets and unemployment starts to pick up. The slowdown comes as retailers enter the “golden quarter” — the run-up to Christmas when stores can make a majority of their yearly profits.

Many consumers delayed purchases of autumn and winter clothing after the warmest September for England and Wales on record saw temperatures exceed 30C (86F) on some days.

A question mark remains over October, too, with temperatures still well above average for the time of the year. Fears about the impact on high street fashion brands on Monday hammered the shares of Next Plc, Marks & Spencer Group Plc, JD Sports Fashion Plc and Primark owner Associated British Foods Plc.

“Big-ticket items such as furniture and electricals performed poorly as consumers limited spending in the face of higher housing, rental and fuel costs,” said Helen Dickinson, chief executive of the BRC. “The Indian summer also meant sales of autumnal clothing, knitwear and coats, have yet to materialize.”

Non-food sales fell in September from a year earlier, the BRC said, while food sales rose.

The figures add to indicators suggesting the risk of recession is rising as successive Bank of England interest-rate increases to tame inflation take their toll. The closely watched PMI index signaled a contraction in August and September, and unemployment has risen for three straight months.

“The fight for Christmas shoppers will be fierce this year, with promotions likely to be earlier and abundant in a bid to loosen tight household purse strings,” said Paul Martin, UK head of retail at KPMG. “Consumers will continue to seek out good deals, with price driving purchasing decisions. This is likely to be one of the most important golden quarters that we have seen in years.”