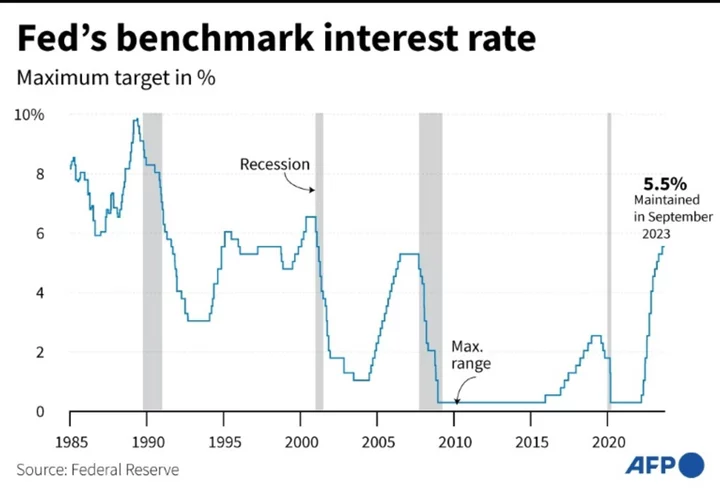

The Federal Reserve will likely announce it is holding interest rates at a 22-year high on Wednesday, as it looks to tackle inflation without damaging the resilient US economy.

Analysts and traders parsing recent Fed speeches overwhelmingly expect the US central bank to hold rates steady for the second meeting in a row as it looks to return inflation to its long-term target of two percent.

"Fed commentary has all but confirmed that the Fed will stay on hold in November," Bank of America economists wrote in a recent note to clients.

Interest rate hikes slow down inflation by raising the cost of borrowing from the bank, which dampens economic activity and weakens the labor market.

Since peaking at more than seven percent in June last year, inflation as measured by the Fed's favored yardstick has fallen by more than half -- though it remains stuck firmly above three percent.

Futures traders assign a probability of 99.9 percent that the Fed will vote to hold rates steady in November, according to CME Group data.

- Resilient economy -

In a surprising development for many analysts, the Fed's aggressive interest rate policy has not pushed the world's largest economy into a recession, and it looks unlikely to do so in the coming months.

In fact, resilient consumer spending fueled higher-than-expected annualized growth of 4.9 percent in the third quarter, building on positive growth in the first half of the year.

At the same time, hiring has picked up and unemployment remains close to historic lows.

"I always say it is a mistake to bet against the American people," President Joe Biden said in a statement Thursday, shortly after the latest GDP figures were released.

"I never believed we would need a recession to bring inflation down -- and today we saw again that the American economy continues to grow even as inflation has come down," he added.

Another factor weighing on the Fed as it mulls whether to hold its key short-term lending rate steady has been the recent surge in yields on longer-term government bonds.

Whereas the Fed's key short-term rate mainly affects the borrowing rates offered by banks, Treasury yields determine "everything from mortgage rates to corporate and municipal bond yields," KPMG Chief Economist Diane Swonk wrote in a recent note to clients.

"It has already added an Arctic blast to the mortgage winter, which has frozen current owners in place and locked first-time buyers out of the housing market," she said.

"Many within the Fed believe that the rise in yields we have seen are equivalent to an additional rate hike," she added.

- Fed future less certain -

Since the Fed's last rate-setting meeting, when most policymakers indicated they expected at least one more increase this year, officials have moderated their tone about further hikes.

Earlier this month, Fed Chair Jerome Powell said the current policy stance is "restrictive," suggesting monetary policy was working to put "downward pressure on economic activity and inflation."

The economy "is handling much higher rates -- at least for now -- without difficulty," he continued.

And Philadelphia Fed President Patrick Harker said he believed the Fed was "at the point where we can hold rates where they are."

"I think doing nothing at this moment equates to doing quite a lot," he added.

Against this backdrop, many analysts have indicated they expect a "hawkish" pause -- whereby the Fed holds rates steady while indicating it could still hike rates again this year if needed.

Deutsche Bank economists wrote in an investor note that a November hike is "off the table," while indicating further hikes would "depend on if tight financial conditions are sustained and the evolution of the economy."

And Bank of America's economists said they expect a final rate hike in December due to the "strong" economic data seen in September, adding that it was "a close call."

While the US economy remains resilient, Fed officials have warned that the current conflict between Israel and Hamas in Gaza could affect America's economy.

"Geopolitical tensions are highly elevated and pose important risks to global economic activity," Powell warned in a recent speech.

The Fed later warned in a financial stability report that escalation of this conflict, or the war in Ukraine, "could reduce economic activity and boost inflation worldwide."

da/bbk/mlm