By Richard Cowan

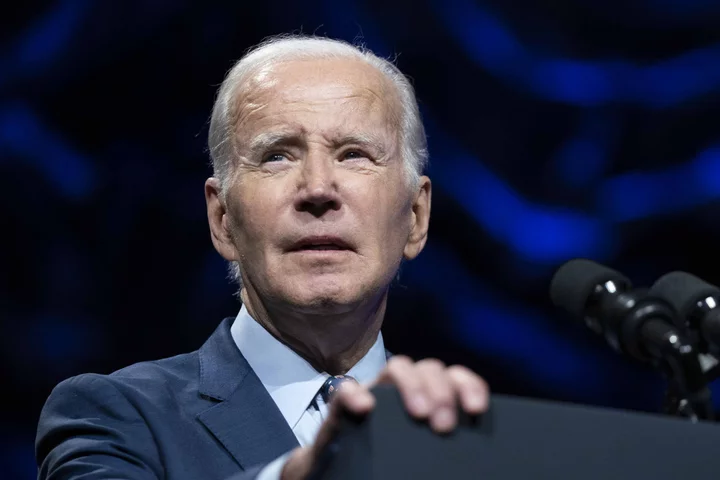

WASHINGTON Republicans in the U.S. House of Representatives on Friday unveiled a series of new tax breaks aimed at businesses and families while proposing to reverse some of President Joe Biden's legislative victories, including credits to spur the sale of clean-burning electric vehicles.

Three related bills were introduced on Friday with the goal of moving the legislation through the House Ways and Means Committee next week.

The Joint Committee on Taxation is expected to release its analysis of the package next week, including any potential costs from revenue losses tied to the proposed legislation.

"These policies will provide relief for working families, strengthen small businesses, grow jobs, and protect American innovation and competitiveness," Ways and Means Chairman Jason Smith, a Missouri Republican, said in a statement.

The committee said there are hundreds of billions of dollars worth of provisions included. Some of those are expansions of tax breaks while others eliminate or roll back existing breaks, according to the tax-writing panel, including Biden's electric vehicle credit.

Republicans, who control the House, introduced the proposals just days after Biden, a Democrat, signed into law legislation Republicans sought to begin addressing the rapidly-growing national debt with about $1.3 trillion in spending cuts.

They were coupled with an urgently needed increase in U.S. borrowing authority by suspending the debt limit through Jan. 1, 2025.

Democrats said the tax measures Republicans seek would impede deficit-reduction efforts.

Republicans have constructed a tax package that would "blow a massive hole in the deficit," said U.S. Representative Suzan DelBene, a Democratic member of the Ways and Means Committee from Washington state.

"On the heels of their (Republicans') debt crisis, this is the height of their hypocrisy," DelBene said.

Under the proposed legislation, married couples filing jointly would receive a $4,000 "deduction bonus" for two years that the committee said would potentially help up to 107 million families who take the standard deduction.

The legislation also would significantly increase the way businesses could claim depreciation deductions, raising the threshold to a permanent $2.5 million from the current $1 million that was contained in the Republicans' broad 2017 tax cut package.

Other provisions include an expansion of tax benefits for small start-up enterprises to "S Corporations," while eliminating some "red tape" that small businesses experience related to contract workers.

Democrats on the Ways and Means panel are expected to offer a series of amendments to the bill, including a permanent expansion of an expired portion of the Child Tax Credit that lifted nearly 4 million children out of poverty in just one year during the coronavirus pandemic. Republicans have opposed the measure.

Any bill that emerges from the House would likely face stiff opposition in the Democratic-controlled Senate.

(Reporting by Richard Cowan; Editing by Paul Simao)