A closely watched measure of US inflation will probably illustrate more of the moderate price growth that the Federal Reserve wants to see sustained.

The consumer price index is projected to rise 0.2% in July for a second month after excluding food and energy costs, marking the smallest back-to-back gains in 2 1/2 years. Economists and Fed officials view this core measure as a better indicator of underlying inflation.

Compared with a year earlier, the Labor Department’s underlying gauge is forecast to rise 4.8%, according to the median projection in a Bloomberg survey of economists ahead of Thursday’s report. While that’s similar to June, the figure is likely to retreat in coming months because core inflation accelerated in August and September of last year.

What Bloomberg Economics Says:

“The labor market is cooling, providing a disinflationary impulse to the stickiest inflation categories that should last the rest of the year. The FOMC’s July rate hike likely was the final one before an extended pause.”

—Anna Wong and Stuart Paul. For full analysis, click here

For the overall CPI, which includes food and energy, so-called base effects will work in the opposite direction. Annual CPI is expected to accelerated to //3.3%. That’s because in July of last year, the measure started to ease from a peak of 9.1%.

A core CPI that underscores further disinflation would be consistent with market expectations that the Fed will hold off raising interest rates in September after a quarter percentage-point hike last month. Officials will have further looks at a variety of price data before their next policy meeting in September.

- For more, read Bloomberg Economics’ full Week Ahead for the US

The Philadelphia Fed’s Patrick Harker and Atlanta Fed’s Raphael Bostic are among US central bank officials speaking next week.

For months, signs of slower price growth have been evident in measures of prices paid by businesses. On Friday, the government’s core producer price index is forecast to rise 2.3% from July of last year.

That’s in line with pre-pandemic annual price gains and well below last year’s peak of 9.7%, largely underscoring goods disinflation.

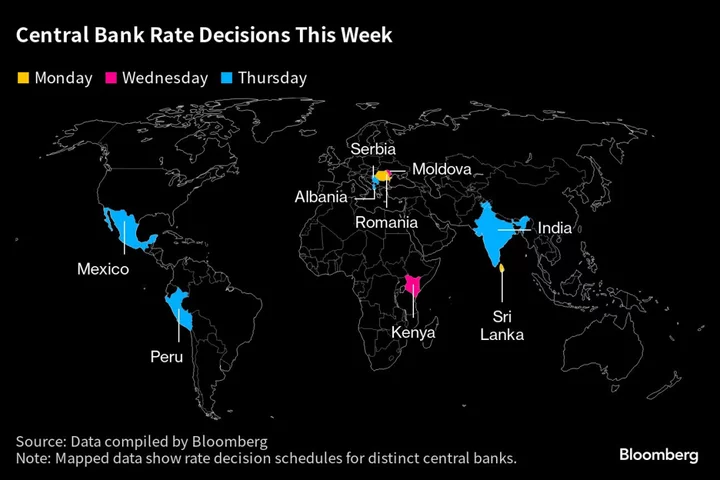

Elsewhere, a possible drop in Chinese consumer prices, UK growth probably stalling and rate decisions from India to Mexico will keep investors on their toes.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

In China, data Wednesday could show consumer prices dropping for the first time in over two years as concerns grow over deflationary risk in the world’s second largest economy. Trade figures should also show the state of demand.

Investors will be closely watching the Bank of Japan’s moves following last month’s surprise change to its yield curve control program, and its decision to step into markets multiple times as 10-year yields rise.

The summary of opinions from the July meeting on Monday could give more insight into the BOJ’s thinking, while wage data on Tuesday could have implications for policy further out.

The Reserve Bank of India is likely to keep rates on hold on Thursday as the monetary authority looks to preserve growth while beating back inflation.

Elsewhere in the region, second-quarter gross domestic product data from Indonesia, and the Philippines and Malaysia should show the state of growth in Southeast Asia.

Australia releases job advertisement data on Monday, providing a forward-view on what has been an ultra-tight labor market.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The resilience of the UK to ramped-up rate hikes will be the focus as GDP data for June, rounding off the second quarter, are released on Friday. Economists are split on whether the economy limped on or whether the growth stalled.

Over in the euro zone, the European Central Bank’s consumer expectations survey on Tuesday will be a highlight, showing whether households anticipate inflation to slow even further than in recent reports.

In terms of hard data, German industrial production for June will be key. The report on Monday is likely to show further weakness that left Europe’s biggest economy struggling to grow in the second quarter.

Over in Central and Eastern Europe, two key rate decisions will draw attention:

- Romania’s central bank will probably keep the benchmark unchanged for a fifth meeting on Monday, as policymakers assess the impact of a government plan to cut spending and adjust a taxation system for businesses.

- In Serbia on Thursday, officials will consider whether to push ahead with rate hikes, following surprise increases in recent months.

Hungarian inflation on Tuesday will probably have slowed to below 20% for the first time in almost a year, while remaining at by far the fastest in the European Union.

In Russia, consumer-price data for July on Wednesday will be the first since the central bank warned of “persistent” pressures in the economy after it hiked rates.

And on Friday, GDP data there may show growth of 3.5% in the second quarter from a year earlier, as state spending particularly on defense production boosts an economy still adjusting to international sanctions.

Looking south, Turkish data on Friday are expected to post a current-account surplus for June — its first since late 2021. The data will probably reflect strong tourism revenue and a seasonal fall in energy imports.

Nearby in Egypt, numbers the previous day may show inflation slowed to 35% last month, just down from June’s record 35.7%. That’s largely down to the government refraining from raising electricity tariffs and the pound appreciating.

Elsewhere on the African continent, Kenyan monetary policymakers will likely hold rates on Wednesday after inflation slowed in July and moved into the central bank’s 2.5% to 7.5% target range earlier than it expected.

In Ghana the same day, data may show consumer-price growth below 40% last month for the first time since September.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Brazil’s central bank on Monday posts its Focus survey of economists before Tuesday’s release of the minutes of its Aug. 1-2 meeting.

The board voted 5-4 vote for a half-point cut to 13.25% and said future rate reductions are likely to be of the same magnitude.

Brazil also reports June retail sales, GDP-proxy figures as well the July reading of the benchmark inflation index, which is expected to jump back over the 3.25% target with last July’s -0.68% print falling out of the 12-month calculation.

In Chile, inflation is cooling fast, with the July headline print expected to have declined by more than 100 basis points for a fourth month to roughly 6.4%.

Colombia consumer price increases topped out in March at 13.34% and economists see inflation slowing for a fourth month in July to roughly 11.6%.

Nothing in Mexico’s monthly and bi-weekly inflation reports posted this week will tip the balance of Banxico’s board into a cut from the current 11.25% at this week’s meeting.

Likewise, Julio Velarde, Banco Central de Reserva del Perú’s chief, probably isn’t quite there yet, so look for the bank’s board to hold at 7.75% for one more month with a cut a very real possibility come September.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Andrea Dudik, Tony Halpin, Robert Jameson, Yuko Takeo, Monique Vanek, Paul Wallace and Sylvia Westall.