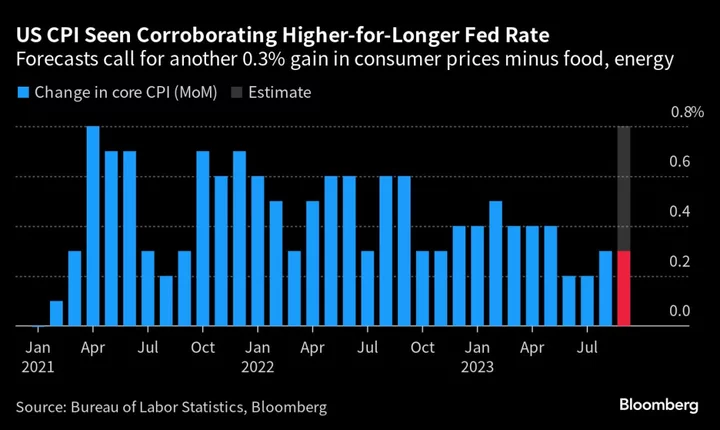

Underlying US inflation is seen rising at a monthly pace that corroborates the message from central bankers that interest rates will need to stay higher for longer.

The consumer price index excluding food and fuel, a measure favored by economists as a better indicator of underlying price pressures, is seen increasing 0.3% for a second month. On an annual basis, the core CPI is projected to cool, but that’s a reflection of base effects: the index in September of last year rose the most since 1982.

Resilient demand in the world’s largest economy, bolstered by unrelenting job growth, has complicated Federal Reserve efforts to get inflation down to its preferred level.

While easing, price pressures are nonetheless proving sticky — a reason why Fed officials have been vocal about the need for their benchmark rate to remain elevated for an extended period. That message has resonated in credit markets, where Treasury yields have recently spiked.

Read more: The 5% Bond Market Means Pain Is Heading Everyone’s Way

Minutes of the Fed’s September meeting, due on Wednesday, may help shed light on how much central bankers are leaning toward raising interest rates again before the end of the year. The next policy decision comes on Nov. 1.

- For more, read Bloomberg Economics’ full Week Ahead for the US

A slew of US central bankers will speak in the coming week, including Vice Chair Philip Jefferson. Governor Christopher Waller and regional Fed presidents Lorie Logan, Raphael Bostic, Neel Kashkari and Susan Collins also speak.

On Wednesday, the government’s producer price index is expected to be consistent with more moderate wholesale inflation.

What Bloomberg Economics Says:

“The blowout September jobs report didn’t settle the debate about whether the Fed is done hiking rates. Two critical upcoming economic indicators — CPI and the University of Michigan consumer-sentiment survey — may give a more definitive read. We expect September core CPI inflation to come in somewhat higher than consistent with the Fed’s 2% mandate, while higher gasoline prices may have pushed up short-term inflation expectations in the preliminary UMichigan survey for October.”

—Anna Wong, Stuart Paul and Eliza Winger, economists. For full analysis, click here

No key interest-rate decisions are scheduled in this week as the global central banking community convenes in the Moroccan city of Marrakech for annual meetings of the International Monetary Fund and the World Bank.

Aside from multiple events and speeches featuring leading monetary officials, the IMF’s World Economic Outlook, featuring a new round of forecasts, will be released on Tuesday.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

China’s new central bank chief Pan Gongsheng is set to make his first big international appearance in Marrakech. Investors and policymakers will want to know his views on China’s economy, property market, and the likely path of monetary policy.

Bank of Japan Governor Kazuo Ueda and Japanese finance minister Shunichi Suzuki will also be on hand after recent intervention speculation, as will a host of other key finance officials.

Through the week, trade data from China, the Philippines and Taiwan will give an update on the latest state of global demand.

Reserve Bank of Australia Assistant Governor Chris Kent is set to speak after the RBA held rates at its first meeting under new Governor Michele Bullock.

At the end of the week Malaysia unveils its budget plans, while China will also report its latest inflation figures.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

While central-bank chiefs from around the region — including European Central Bank President Christine Lagarde and Bank of England Governor Andrew Bailey — gather in Marrakech, few speaking events are scheduled away from the IMF meetings.

Key data will still be released for the euro area. Industrial production in Germany on Monday and Italy on Tuesday will show how factory output in those two major economies is faring amid persistent weakness driven by poor global demand.

Overall numbers for the euro zone will then be published on Thursday.

Minutes of the ECB’s September meeting are due the same day, which investors will scrutinize for any hints on the spectrum of opinion on the Governing Council and clues for future action. The ECB releases its report on consumer inflation expectations two days earlier.

In the UK, monthly gross domestic product data for August comes on Thursday, anticipated by economists to show a small increase that doesn’t make up for July’s 0.5% drop.

Elsewhere in Europe, inflation data will be closely watched across the Nordics at a time when investors are questioning how further tightening has to run in some of those economies. Numbers are due in Norway, Denmark and Sweden.

Hungary will publish consumer-price numbers on Tuesday. Inflation at over 16% continues to be the highest in the European Union, even after slowing for a seventh month.

Further south, investors will watch to see if data the same day shows Egypt’s inflation accelerated further into record territory. The central bank is trying to slow it and help ease pressure on the pound.

Turkey’s current-account deficit is expected to shrink significantly in August, to $500 million, according to a Bloomberg survey of economists. If the data on Wednesday confirms that, it may help ease pressure on the lira.

Ghana’s inflation data on Wednesday are predicted to have slowed for a second straight month in September, providing room for the central bank to hold rates in November.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

In Mexico, the early consensus has both monthly and mid-month inflation results supporting Banxico’s hawkish stance. While the full September reading likely slowed for an eighth month, the print for the second half of the month merely inched lower.

The minutes of Banxico’s Sept. 28 decision — the board voted unanimously to hold rates at 11.25% for a fourth meeting — should hammer home the post-decision statement’s higher-for-longer message, emphasizing that the inflation outlook remains “complicated and uncertain.”

On Wednesday, analysts expect Brazil’s September inflation print to have breached the top of the central bank’s 1.75% to 4.75% target range, just three months after falling below the 3.25% mid-point in June.

In Chile, September’s trade balance, copper exports and the central bank’s survey of economists are the highlight, while Colombia reports consumer confidence, retail sales, manufacturing and industrial production data.

In the last major economic release before its Oct. 22 presidential election, Argentina posts national consumer prices results for September.

The monthly reading may come off the three-decade high of 12.4%, but not by much, with the year-on-year print possibly passing 135%. Private economists surveyed by the central bank see it hitting 169.3% for 2023.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Laura Dhillon Kane, Tony Halpin, Robert Jameson, Yuko Takeo, Monique Vanek and Paul Wallace.