Deep in the bowels of Wall Street there’s a surprisingly successful counterfeiting operation underway: The world’s largest banks have created a booming business churning out imitation quant trades.

JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley are among those hawking the products, which are known by the deceptively dreary name “quantitative investment strategies,” or QIS.

It’s the latest chapter in the ongoing demystification of high finance. These trades — numbering in their thousands and supplied to pension funds, family offices and the like — replicate strategies pioneered by Ivy League academics and systematic fund managers like AQR Capital Management.

The twist is that QIS aren’t funds — the banks turn the trades into swaps or structured notes, making them easy to package and sell so clients can pick and choose what they want. It’s a buffet, not a tasting menu.

QIS run the gamut of quant investing styles, which try to make money from market patterns established in academic research, such as the tendency for cheap stocks to outperform or for assets to trade in the same direction for a while. They originally boomed after the financial crisis as banks, squeezed by new regulations, began turning their internal trading strategies into products they could sell.

After enjoying a performance revival in the post-pandemic era along with the broader quant industry, QIS trades have grown steadily in recent years and now command about $370 billion of assets, according to an estimate from consultancy Albourne Partners.

“Last year was probably the best year I’ve seen in many,” said Spyros Mesomeris, global head of structuring at UBS Group AG. “What people have been asking for is simply strategies that are able to perform in an environment of equity and bond market turbulence.”

QIS trades come with a handbook about exactly how they work – say, go long S&P 500 futures if they’ve risen above a 20-day moving average, in one simplification. The idea is that makes them transparent, and because investors only buy what they want, they tend to be cheaper than most money managers, proponents say.

At Veritas Pension Insurance in Finland, which runs about €4 billion ($4.3 billion), Chief Investment Officer Kari Vatanen has turned to QIS to have more control of the firm’s money without having to build trading teams from scratch.

“The good point there is they are fully transparent — we know how they are constructed,” Vatanen said. “It’s basically in our hands, like ETFs in equity markets.”

Skeptics point out that banks don’t have a fiduciary duty — the obligation to act in a client’s best interest — in the same way a money manager does, and that they don’t focus as much on minimizing transaction costs since they also execute the trades. Some also say the strategies are unoriginal and simplified.

“The things that we do on the alpha side or even on the risk premia side is beyond writing it in a simple rulebook,” said Deepak Gurnani, founder of Versor Investments, which runs about $1.8 billion including hedge fund and risk premia strategies.

Still, according to a survey of 13 banks by Albourne, assets run by QIS have grown an average 3% annually over the last six years to reach about $370 billion by mid-2022.

Evelina Klerides, a partner at the consultancy, said the demand stems from investors seeking products with high transparency and lower costs. The downside is that the rapidly increasing range of providers and strategies “require careful selection and monitoring,” she said.

While the business is typically seen as a substitute for hedge funds, even the fast money itself is increasingly turning to QIS to quickly add new exposures to their arsenal, according to Mesomeris at UBS and Arnaud Jobert at JPMorgan.

The notional amount linked to JPMorgan’s QIS indexes rose 30% last year, after staying largely flat in the three years through 2020.

“You needed to find some diversification and bonds were no longer an answer to that,” said Jobert, co-head of global investible indices at the Wall Street giant. “Things like trend following or rates volatility have been quick and immediate overlay solutions.”

Given the opaque nature of the business and the scope of the trades it’s hard to generalize returns, but data provider Premialab estimated 61% of the roughly 4,000 strategies it tracks made money last year, the highest proportion since at least 2016. More than 1,000 new QIS were also created — the most in six years.

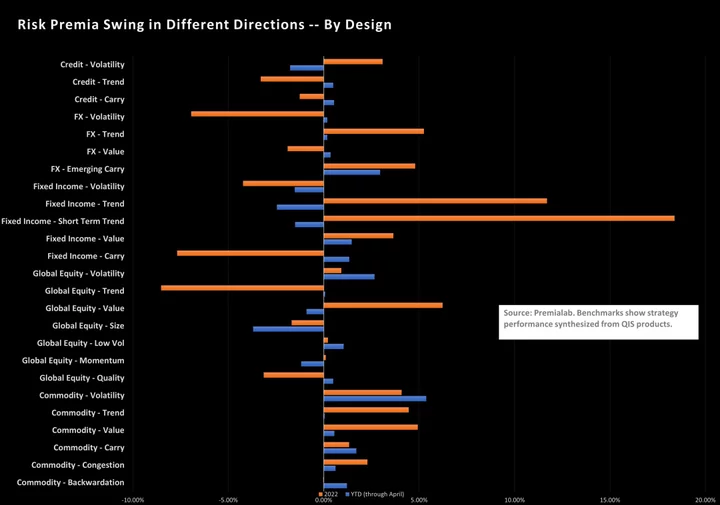

This year has been a more mixed bag as investor attention shifts from inflationary fears to the potential for a recession and rate cuts. A Bloomberg-GSAM index of cross-asset risk premia — an amalgamation of typical styles — is down 1.5% so far in 2023. Premialab’s breakdown shows big reversals for some of last year’s winning trades such as trend-chasing in fixed income, but better days for carry strategies.

QIS aren’t immune to the criticisms leveled at the type of systematic hedge fund that popularized many of these strategies. A 2021 academic study argued these trades in general don’t offer much of an edge over more traditional benchmarks.

“You cannot say that one part of the market is doing a much better job than the other,” said one of the co-authors Antti Suhonen, who’s also an adviser to the investment consultancy MJ Hudson. “Most of these strategies don’t really add diversification, especially when things go really bad.”