The Swiss experiment to fight imported inflation with the help of a propped-up franc has been, by many measures, a success. The question for traders is whether the currency’s rally can last.

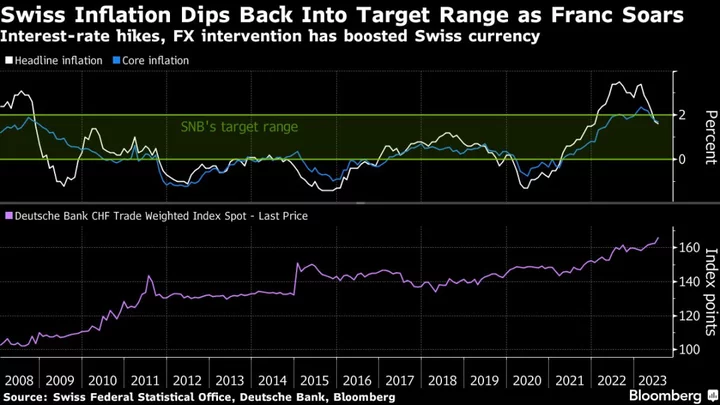

The franc’s trade-weighted exchange rate has soared as policymakers boosted interest rates and intervened in the currency market to wrestle inflation back down to within the central bank’s target.

Now, strategists from Wells Fargo & Co. to Barclays Plc are warning that the franc’s strength could peak if the Swiss National Bank slows — or even halts — purchases in the foreign-exchange market. Traders and speculators, too, have grown more bearish on the currency.

“As the Swiss National Bank becomes a little bit less aggressive in buying, and as the valuation becomes more compelling to sell Swiss, we’ll see a steady topping-out process in the Swiss franc,” said Erik Nelson, a macro strategist at Wells Fargo in London. “For a longer-term asset manager, selling into franc strength makes sense.”

For Nelson, a June remark by central bank chief Thomas Jordan that restrictive financial conditions cause a “dampening effect” offers an early signal that policymakers could start easing their FX intervention.

The central bank embraced an unprecedented tightening campaign and sold more than 60 billion francs ($68.6 billion) of international reserves to boost the local currency and reduce its balance sheet between the second quarter of 2022 and first quarter of 2023.

Those efforts helped inflation ebb to just 1.6% in July, though policymakers predict that price pressures will return.

Even so, Wall Street strategists are starting to wonder how much longer officials will support the franc. It’s among the best-performing Group-of-10 currencies this year so far, against both the dollar and the euro. The franc is also on pace for a seventh-straight year of gains versus its major trade partners.

And there are already signs the franc is at a turning point, especially against the greenback. The currency is poised for a fifth-straight week of declines against the dollar.

Speculators have ramped up their net-short position on the franc more than 10-fold since the end of May, according to Commodity Futures Trading Commission data for the week through Aug. 8.

Institutional investors, meantime, are holding one of their biggest short positions in the currency in the past five years, according to State Street Bank and Trust Co. data.

The timing of any major shifts in monetary policy, however, is still opaque. Economists expect the Swiss National Bank to raise interest rates for a final time in September, even as inflation is seen slowing faster than the central bank has estimated.

Officials have yet to give any clear guidance on their plans for currency interventions, though they’ll release data on second-quarter foreign-exchange sales on Sept. 30.

But to Lefteris Farmakis, a foreign-exchange strategist at Barclays, the clock is ticking for officials to end their direct support of the franc because inflation has returned into the official target range.

“The currency is getting a bit too expensive and there’s now much less need for the Swiss National Bank to buy it,” he said. Farmakis attributes recent gains in the franc to haven-seekers who’ve grown wary of worsening economic data across the euro area, saying the appreciation is “unlikely due to active FX intervention.”

--With assistance from Bastian Benrath.

(Updates franc moves in eighth and ninth paragraph.)